Your house is likely in one of two camps right now: sold or trying to get sold. And every spring, like clockwork, you can be sure that Uncle Sam comes knocking, magnifying glass in hand, to determine whether he can share your gains. As a home seller (and thereby an investor), there are ways you can minimize this capital gains tax — a type of tax on “profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.”

In this case, your house is considered a capital asset and, depending on how much you sell it for and how long you’ve owned and lived in it, there are 5 tax deductions that could apply to you in order to lower your capital gains tax obligation.

When you sell a house, there’s a fine line between what you can deduct and what you cannot. There’s also a ton of confusing information on the internet and, unless you’re a seasoned tax professional, the mystifying tax lingo doesn’t make it any easier to understand.

Lucky for you, we’re here to help you separate fact from fiction, navigate the pesky tax slog and filter the deductions that best apply to your situation come April.

First, let’s tackle the 2 most common questions homeowners ask about deductions:

Do you even need to report the sale of your home to the IRS?

Well, it comes down to a few key factors:

Are you single or married?

According to Nolo, most people “who sell their personal residences qualify for ahome sale tax exclusion” — which means you won’t need to pay taxes on gains of $250,000 for single homeowners and $500,000 for married homeowners filing jointly. However, if your profit exceeds these amounts, you’ll need to pay taxes on the excess.

Is this house your primary residence? How long have you owned and lived in it?

TaxAct explains that to exclude the above gains ($250K and $500K, respectively) from your tax obligation, you need to meet the following 3 qualifications:

- You owned the property for at least two of the last five years.

- You lived in the property for at least two of the last five years.

- You did not exclude the gain from the sale of another house within two years from the sale of this house.

Tip: Did you sell your house for under $250K, if you’re single, or under $500K, if you’re married, — and did you live in it for at least two of the five years before you sold it? If both are true, the IRS doesn’t want to hear about it, according toU.S. Code Section 121.

Are you eligible for a reduced exclusion from your gain?

Let’s say you haven’t had the opportunity to own or live in the house for two of the last five years before the date of sale. According to NerdWallet, you might still be able to take advantage of a reduced or partial exclusion due to special circumstances “such as a change in employment, even if you haven’t met the ownership/residency requirements.”

With that in mind, here are the top deductions — caveats and requirements in tow — that sellers can use to minimize their capital gains tax obligation when tax season rolls around.

Now, let’s go through the various types of real estate tax deductions and debunk some of the most common myths:

Home Improvement Tax Deductions

Myth 1: “I can deduct the costs of maintenance, repairs, and decorating related to preparing my home for sale.”

Fact: Run-of-the-mill home repairs necessary to maintain your property’s condition or get it ready for sale are not tax deductible under current tax code Publication 523. Confusion arises over online reports that may erroneously refer to dated federal IRS code that allowed home sellers to deduct “fixing-up” expenses, such as “the costs of painting the home, planting flowers, and replacing broken windows” completed in the 90 days prior to closing. That tax break no longer exists. Under today’s tax rules, however, you are allowed to increase your cost basis by tacking on additional costs spent on capital improvements for the home.

How to Reduce Your Cost Basis with a Different Tax Break:

Generally speaking, the government wants a piece of any “capital gains” (aka profit) you make from selling off assets like stocks, bonds or—you guessed it—property.

But you can mitigate your tax liability by reducing the amount of home sale profit the IRS considers taxable. If your home sale profits exceed the capital gains exemption threshold ($250,000 for single filers, and $500,000 for married filers) you can add capital improvements to your cost basis. The IRS defines a capital improvement as any home improvement that “adds market value to the home, prolongs its useful life or adapts it to new uses.”

It can sometimes be difficult to determine if the improvement you made before closing was a capital improvement or just a repair.

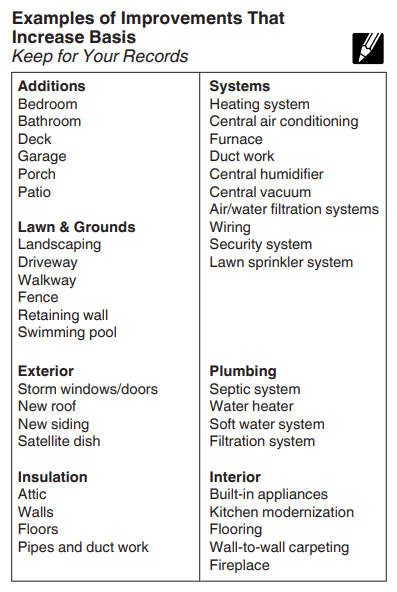

Thankfully, page 9 of IRS Publication 523 provides specific examples of improvements that actually add to the value of the house and, thus, can be deducted from your tax obligation.

Review the list and consider if any of them apply to you.

Home Selling Expense Tax Deductions

Myth: “I can’t deduct my real estate agent’s commission fees.”

Fact: Yet another reason why it’s worth it to hire a top real estate agent!

Not only can they guide you through the daunting process, help sell your house faster and for more money and provide you with advice you can’t get anywhere else, — because your best interest is their best interest — but you can deduct their fees from your capital gains tax obligation, too.

According to Nolo, you can also deduct the following costs when selling your house:

- administrative costs

- advertising costs

- escrow fees

- inspection fees

- legal fees

- title insurance

How to Get These Tax Deductions:

Have you sold your house?

Collect all receipts and invoices that pertain to your individual selling costs — including services you’ve hired for — when you closed on the house, and then file them under separate sections so you’re organized come tax season.

Are you currently selling your house?

While you may not necessarily incur costs from all of the above as you sell your home — with or without the help of a top agent — keep tabs on your spending so you’re not scrambling for numbers in the spring.

Tip: According to the IRS Publication 523, if you, as the seller, paid for “transfer taxes, stamp taxes, or other taxes, fees, and charges when you sold your home” you can treat these as selling expenses and deduct them from your home sale profit.

Tax Deductions for Moving Expenses

Myth: “I can’t deduct moving expenses.”

Fact: Turns out you can — but only if you’re relocating for work.

There’s another stipulation: Home Guides by SFGate explains that to “qualify to write off your moving expenses, your new home must be at least 50 miles closer to your new job than your old home was.”

If that sounds like you, you can deduct the mileage you drive (if applicable), moving company expenses, moving supplies and other travel expenses.

How to Get This Tax Deduction:

Have you already sold your house?

Whether you’re transitioning out of your old house or already settled in your new one, try to make a list of the moving expenses applicable to you — before you start at that new job!

Are you currently selling your house?

If you’re selling your house for work-related reasons — and that’s a big if — it’s never too early to consider how you’ll move yourself, your family and your belongings.

- Are you close enough to the new job that you can drive?

- Do you need to travel by plane?

- Do you need to hire a moving company?

- Do you need moving supplies?

If you answer yes to any of those questions, collect all the receipts.

Tip: Keep the offer letter from your new job on hand when tax season comes around, too. Just in case.

Property Tax Deductions

Myth: “I can deduct all the taxes I paid to local and state

governments, including income, property and sales taxes.”

Fact: This used to be true — before Congress passed, and President Donald Trump signed into law, the Republican tax bill in December of 2017.

According to Business Insider, there is now a limit to how much you can deduct: “…the new law caps the deduction at $10,000, either for property taxes, state and local income taxes or sales tax” — and you can only deduct property taxes if they were assessed by your local government and paid the previous year.

As for when you can officially pass the property tax bill baton? The date the buyer purchases the property — which, TurboTax explains, “is typically listed on the settlement statement you get at closing.”

In other words, the buyer is responsible for taxes on and after the sale date.

How to Get This Tax Deduction:

Have you already sold house?

To make sure you can write off your property taxes, you need to itemize your deductions. While it’s best to work with a tax professional who can crunch the numbers accurately and assess your situation better than we can, it might also be a good idea to review Schedule A (Form 1040) from the IRS to get acquainted with the details of how itemizing real estate taxes work.

Now that you’ve sold the property, make sure to bring your settlement statement to your tax appointment so you have official documentation for the date the buyer took over the house and property taxes.

Are you currently selling your house?

If you have the time, determine an estimate for how much you paid in property taxes last year and how much you’ve paid this year — wherever you’re at in the process of selling your house.

This way, you clearly understand your property tax responsibility and the buyer’s liability come closing time.

So, how do you figure out how much you’ve paid?

You can try these 3 options:

- Use SmartAsset’s property tax calculator for an overview of your state taxes and home value.

- Access your current year payments online from the county assessor to which you pay property taxes

- Retrieve Form 1098 from your mortgage lender — which “…lists any real estate taxes your lender paid on your behalf through an escrow account,” according to Zacks Investment Research.

Mortgage Interest Tax Deduction

Myth: “If I have a home mortgage, I can’t deduct mortgage interest.”

Fact:

Americans have long enjoyed the mortgage interest tax break as one of the major benefits of owning a home. As of 2018 the IRS allows you to deduct interest on up to $750,000 of a loan (down from $1 million for loans obtained before the new Tax Code took effect). But even with the lower cap, most homeowners are able to deduct mortgage interest in its entirety using Form 1040, Schedule A.

In addition to mortgage interest, you should also check into whether you can deduct mortgage “points,” which describe charges you may have paid to get a mortgage like prepaid interest or loan origination fees.

However, keep in mind there are 9 requirements you must fall under to “deduct the points in full in the year you pay them,” which you can find on this page.

Still, as a homeowner looking to sell your house, it’s in your best interest to work with a tax professional who can both guide you through the itemizations form and confirm if you can write off mortgage interest and mortgage points, given the requirements.

How to Get This Tax Deduction:

Have you already sold your house?

Whether you sold you house at the beginning, middle or end of the year, we suggest you get your documents in order sooner rather than later so that you’re not forgetting about charges you incurred that could be written off.

For the mortgage interest deduction, consider printing itemization Form 1040 ahead of time and reviewing it. Then, once tax season rolls around, be on the lookout to receive Form 1098 from your lender, which will summarize the mortgage interest you paid for the year (the IRS requires that your lender sent it to you). You can use Form 1098 as you make inputs on your tax software, or simply provide the document to your tax professional as their prepare your returns and they’ll know how to use it for itemization.

Are you currently selling your house?

No matter how long your house has been on the market, if you have a mortgage on the house you’re selling — and it’s your main house — there’s a good chance you can deduct your mortgage interest from your taxes.

At this point, while your full attention should be on selling your home quickly and for as much money as possible — preferably with the help of an experienced agent — it doesn’t hurt to start reviewing the mortgage interest charges you’ve incurred since the last time you filed.

Here’s the Bottom Line on Tax Deductions When Selling Your House

There’s a lot of information here. We know. But as you walk away, we want to leave you with a few parting points — whether you’re currently selling your house or you’ve already sold it and passed the baton to its new rightful owner:

- Stay organized. Save all receipts and invoices since the last time you filed your taxes. File them.

- Become friends with IRS Publication 523 on Selling Your Home.

- Become friends with Schedule A (Form 1040) on Itemized Deductions.

- Remember the $250K deduction threshold for single homeowners and the $500K deduction threshold if you’re married and filing jointly.

- Add capital improvements to your cost basis to mitigate your capital gains tax burden.

- Hire a top real estate agent who can sell your house faster and for more money — and bonus: remember you can write off their fees.

When in doubt, we encourage sellers — and potential sellers — to consult with a tax advisor as deduction rules can vary from state-to-state, year-to-year and even administration-to-administration.

This way, you’ll feel more confident about maximizing the deductions available to you — given your marital status, your ownership and living situation and the dollar amount for which you sell your house.

by Amanda Hanna Posted on

Disclaimer: This article is not intended to be used as legal or professional tax advice; for questions or further information, please consult a skilled CPA.