Reported by Jonathan Miller’s Housing Notes: August 31, 2018

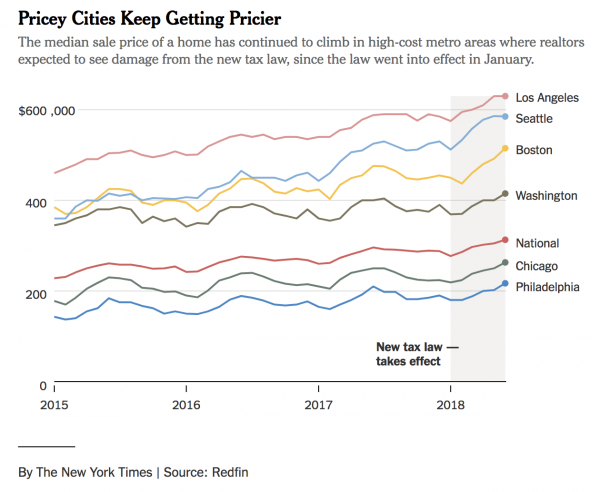

I came across a New York Times piece that looked at price trends as indicative that there has been no real impact from the new federal tax law on the housing market. The Trump Tax Cuts Were Supposed to Depress Housing Prices. They Haven’t.

It was a rehash of a Ken Harney piece in the Washington Post on June 13th: The new tax law was supposed to cause a slump in housing values. It hasn’t materialized — yet.

Relying on price trends is the same flawed logic used during the housing bubble. Pick any market back then. Housing sales fell sharply eventually leading to a sharp drop in prices. Peak prices nationwide were seen in 2006 while peak sales were achieved a year earlier. I continue to be amazed at how this continues to be missed in economic circles.

Think of a seller anchored to a ridiculously high list price. It takes them 1-2 years to de-anchor and not feel like they haven’t left money on the table. What happens when a housing market is exposed to a federal new tax law overnight? The sellers continue to demand their price and a rising number of buyers opt not to pay it. In other words, sales decline first. This is exactly what is happening in high tax, high-cost states right now.

And it is true, the new federal tax law likely won’t have any real impact in 80% of U.S. markets because of their much lower housing prices, mortgage amounts. property taxes and SALT. The doubling of standard deductions made it irrelevant. But let’s not proclaim the same goes for the entire U.S. when without too much effort you can see the slowdown in real-time in high-cost markets. This article treated the national housing market as, well, a single market. The new federal tax law, as far as housing goes, was designed to have the most impact on high-cost housing markets such as those found on the west coast and the northeast and the reform aspect centered on reducing the amount of itemization.

We are seeing slowing sales in the northeast and west coast right now, 9 months after the law became effective. Price trends are not a reliable basis for the premise being suggested in this piece. Here’s how it goes:

- external impact (tax law)

- sales decline (yes)

- inventory rises (happening now in the U.S. including NE and West)

- prices slip (next)

In other words, 9 months is way too early to be calling for no impact. We can see it happening in NYC right now.