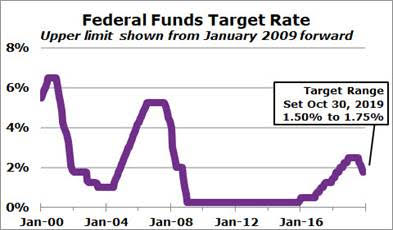

The Fed cuts its target rate again

The Federal Reserve lowered its target range for the federal funds rate on Wednesday, October 30, its third rate cut in the last three months. The move was highly anticipated by market analysts.

The Federal Reserve lowered its target range for the federal funds rate on Wednesday, October 30, its third rate cut in the last three months. The move was highly anticipated by market analysts.

The target range, the Fed’s primary policy lever for short-term interest rates, was cut by 25 basis points and is now 1.50% to 1.75%.1

The previous two rate cuts, which took effect on August 1 and September 19, were also 25-basis point reductions.

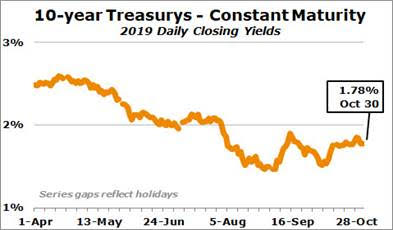

Mortgage rates react to more economic and financial factors than  just the Fed’s policy on the short-term side of the financial markets. Consequently, the Fed’s action doesn’t necessarily imply any particular direction for mortgage rates.

just the Fed’s policy on the short-term side of the financial markets. Consequently, the Fed’s action doesn’t necessarily imply any particular direction for mortgage rates.

One important guidepost for mortgage pricing is the yield on the 10-year Treasury note, which closed at 1.78% on Wednesday, October 30.2 The yield has averaged 1.81% over the past five trading days. In September, the yield averaged 1.70%.

The gap between the yields on the 2-year and 10-year Treasury securities has increased in October. With one trading day to go in the month, October has seen the 2-year Treasury average 1.55% while the 10-year averaged 1.71%. The resulting yield curve gap of 16 basis points is up from September’s 5 basis points. In October 2018, the yield curve gap was 29 basis points. Financial markets consider a negative yield curve gap an indicator of an oncoming recession.

Reported by Brian Scott Cohen Wells Fargo Home Mortgage, October 31, 2019