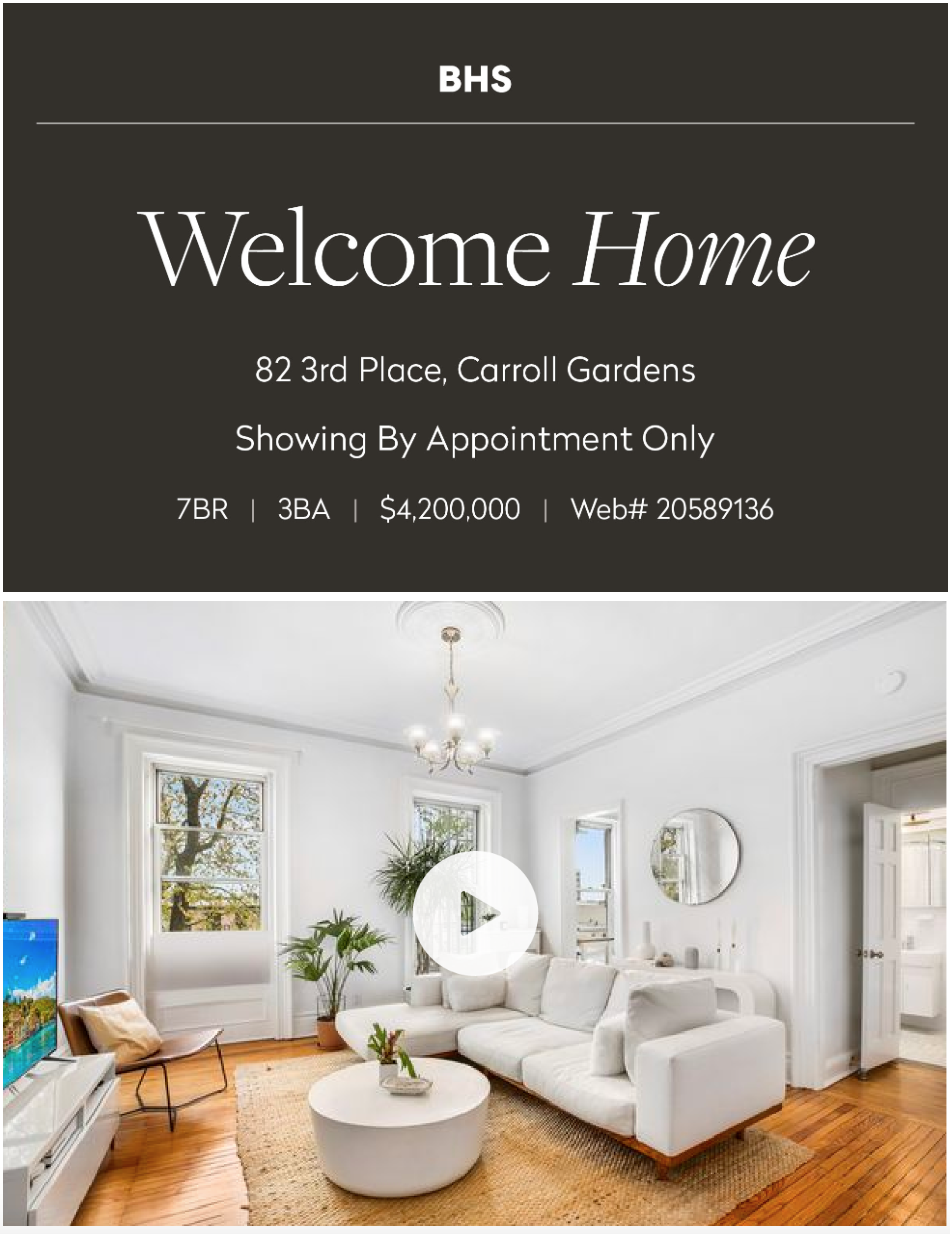

Showing by Appt Only Thursday July 29th 4-5pm – Graceful 25′ Wide Carroll Gardens Brownstone

Category: Featured

N.Y.C. will require workers and customers show proof of at least one dose for indoor dining and other activities.

New York City will become the first U.S. city to require proof of at least one dose of a coronavirus vaccine for a variety of activities for workers and customers — indoor dining, gyms and performances — to put pressure on people to get vaccinated, Mayor Bill de Blasio announced Tuesday morning.

The program, similar to mandates issued in France and Italy last month, will start on Aug. 16, and after a transition period, enforcement will begin on Sept. 13, when schools are expected to reopen and more workers could return to offices in Manhattan. Mr. de Blasio has been moving aggressively to get more New Yorkers vaccinated to curtail a third wave of coronavirus cases amid concern about the spread of the Delta variant. He is also requiring city workers to get vaccinated or to face weekly testing, and he has offered a $100 incentive for the public.

“If you want to participate in our society fully, you’ve got to get vaccinated,” he said at a news conference. “It’s time.”

“This is going to be a requirement,” he added. “The only way to patronize these establishments is if you are vaccinated, at least one dose. The same for folks in terms of work, they will need at least one dose,” he said, holding up a single finger.

On Monday Mr. de Blasio stopped short of reinstating an indoor mask mandate even as large urban areas, including Los Angeles County, San Francisco and Washington, and at least one state did so. He said he wanted to focus on increasing vaccination rates, and was concerned that requiring everyone to wear masks would remove an incentive for those who are considering getting vaccinated now.

Nationally, new cases have reached an average of about 86,000 a day as of Monday, a dramatic jump from about 13,000 daily cases a month ago but still far fewer than in January. Hospitalizations have risen as well, but hospitalizations and deaths remain a fraction of their devastating winter peaks.

About 66 percent of adults in the city are fully vaccinated, according to city data, although pockets of the city have lower rates. The federal government has authorized three vaccines for emergency use in the United States: The Pfizer-BioNTech and Moderna vaccines both take two doses while Johnson & Johnson uses a single dose. Individuals are not considered to be fully vaccinated until two weeks after their final dose.

Fully vaccinated people are protected against the worst outcomes of Covid-19 caused by the Delta variant, but there’s a sharp drop in the efficacy if an individual has only had one dose of a two-dose vaccine.

The new program, dubbed “Key to NYC Pass,” is not a particular document, but rather the strategy of requiring proof of vaccination for workers and customers at indoor dining, gyms, entertainment and performances, including Broadway, the mayor said.

Indoor movies and concerts will also require people to show proof of vaccination to enter. People will be able to continue to dine outdoors without showing proof of vaccination.

To enter indoor venues, patrons must use the city’s new app, the state’s Excelsior app or a paper card to show proof of vaccination. The mayor did not say how the city will handle vaccinations like AstraZeneca or Sinovac that may be common among international tourists.

Children younger than age 12 will not be excluded from venues because they are not eligible to be vaccinated, he said. But the details of those plans remain to be worked out. “We have to figure out how to do things in a safe manner,” the mayor said.

The city will issue a health commissioner’s order and a mayoral executive order to put the vaccine mandate in place. The six weeks before enforcement begins on Sept. 13 will be spent educating businesses and doing outreach, he said.

The mayor said the city consulted with the U.S. Department of Justice and got a “very clear message” that it was legal to move forward with these mandates, even without full F.D.A. approval.

Only people fully vaccinated in the state of New York can get an Excelsior pass, which confirms vaccination against city and state records. Everyone, however, can use the city’s new app, NYC Covid Safe, because it is simply a digital photo album that stores a picture that a person takes of their own vaccination card and does not double check it against any registry. A paper card from the Centers for Disease Control and Prevention must always be accepted, too.

Emma G. Fitzsimmons is the City Hall bureau chief, covering politics in New York City. She previously covered the transit beat and breaking news. @emmagf

Sharon Otterman has been a reporter at The Times since 2008, primarily covering education and religion for Metro. She won a Polk Award for Justice Reporting in 2013 for her role in exposing a pattern of wrongful convictions in Brooklyn. @sharonNYT

Joseph Goldstein covers health care in New York, following years of criminal justice and police reporting for the Metro desk. He also spent a year reporting on Afghanistan from The Times’s Kabul bureau. @JoeKGoldstein

Emma G. Fitzsimmons, Sharon Otterman and Aug. 3, 2021

New to Market! 3 Family Brownstone Carroll Gardens

Upcoming Open House

By Appointment Only: Sunday, June 27, 2021, 1:00 – 2:00

By Appointment Only: Wednesday, June 30, 2021, 1:00 – 2:00

Go to our listing at BHS

iBuyer Power Move? Agents Onto Zillow’s Zestimate Upgrade

Real Estate Industry Calls Zestimate’s Accuracy Into Question, Even After Upgrades

Zillow recently announced the launch of its revised Zestimate model, alleging a more accurate assessment of home values. But who is this data for and how precise is it? Recent moves suggest the motive for the portal-turned-brokerage is simply to funnel more seller leads to Zillow Homes‘ pipeline.

“Let’s keep in mind that Zillow’s primary interest in tweaking the Zestimate is to support Zillow Offers; to increase the number of sellers who are inspired by their home’s Zestimate to request an appointment with a Zillow broker,” says Jim Smith, broker/owner, Golden Real Estate.

“It’s a great prospecting tool for them! Get your foot in the door, do a real CMA and buy the home at a price which, by design, is not full value since Zillow isn’t in the business of losing money on resales! A cynic might describe that business model as ‘bait and switch,’” adds Smith.

Zillow actually began monetizing their Zestimate in February of 2021, utilizing the home value estimate as a bargaining chip for the brokerage’s Zillow Offers program. For about 900K eligible homes across 23 real estate markets, the Zestimate transforms into an initial cash offer price for those utilizing the iBuyer option.

According to the company, the upgraded valuation model uses neural networks to leverage deeper property data history, including sales transactions, tax assessments and public records. Due to this, Zillow says it has improved the Zestimate’s national median error by a full percentage point (to 6.9%) for more than 104 million homes.

“Since we introduced the Zestimate in 2006, we have never stopped innovating in order to provide consumers with the most accurate home valuations,” said Dr. Stan Humphries, Zillow chief analytics officer and creator of the Zestimate, in a statement. “The new architecture we’re debuting today represents another significant step forward in our efforts to harness big data to create more certainty for consumers, which leads to better decisions.”

While Zillow has made some improvement to its home valuation model, however, some say the change isn’t drastic enough to be deemed “accurate.”

“Zestimates are definitely impacting the real estate business and how sellers are viewing their current market value. Zestimates are inaccurate on so many different levels,” says Jacqueline Balza, broker of record at Inspired Dream Real Estate, who argues that Zillow still does not take into account all of the property information needed to provide an educated valuation estimate.

“Zestimates do not properly take the age and current conditions of a home into consideration when giving current market value. Because it’s a computer, it doesn’t know what the current condition is. Only a real estate professional can go in and advise the owner on current market value due to the current condition,” adds Balza.

Carrie Lukins, broker/owner at Sellstate Alliance Realty & Property Management agrees—the onus for home valuations should be on real estate agents, not technology.

“Though Zillow may have updated their algorithms for Zestimates, a computer never takes the place of a local expert. A local REALTOR® who has intimate knowledge of your individual market will always be far more superior than Zillow,” says Lukins.

“Their data is culled from the entire nation, not your individual neighborhood,” adds Lukins, who is only incentivized to compete even more amid the increase in data adoption. “We can always appreciate that Zillow is trying to squeeze out the local expert; that just encourages us to educate the consumer and our local community about our value and expertise.”

Not all practitioners hold a pessimistic view. While in the minority, some believe Zillow’s continued foray into big data signals improved resources for agents, home sellers and prospective buyers.

“Zillow is already the most visited real estate website in the country, and that is due, in large part, to their Zestimates,” says Kofi Nartey, broker, Society Real Estate + Development. “With greater accuracy, Zillow will continue to find more alignment with the comps their agent partners are running. Overall, it becomes a win for consumers and agents.”

The overwhelming majority, however, say Zillow’s Zestimates only take away from the accuracy provided by real estate agents and appraisers.

“From my perspective, these computer algorithms have little to no impact as they use a limited set of data to come up with estimates,” says Vini Moolchandani, a broker with Compass Real Estate. “Machine algorithms can solve the objective puzzle to some extent based on availability of data. On the other hand, appraisers and REALTORS® use lots of additional data points that are not possible for any machine to incorporate in their estimates.”

Sebastian Hurtado, an agent working under Balza’s brokerage, says all the evidence one needs is in Zillow’s history.

“The consumer is quick to run to Zillow to get their information, not taking into account the flaws in the algorithm,” says Hurtado. “Sellers get a false idea of what their home is worth. Five years ago, Zillow’s CEO’s home sold for 40% under its Zestimate. That should be all the proof you need to know that the expertise of a professional isn’t quite ready to be replaced by a computerized system.”

As reported by RisMedia.com

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas to lizd@rismedia.com.

Pandemic-Induced City Reshaping

Flattening of rent and price gradients, and the future of work

COVID-19 has been a shot directly at the heart of what makes cities vibrant—the amenities which draw people for plays, retail, restaurants, etc. have been shut down; and at the same time offices have been largely closed while people work remotely. Under those contexts, it is maybe unsurprising that people have moved elsewhere. But are those shifts temporary or permanent? How is this impacting the real estate market—which is seeing an unprecedented boom? Is this pandemic just a temporary blip in the factors that make cities great, or are the ongoing shifts accelerants of broader social changes?

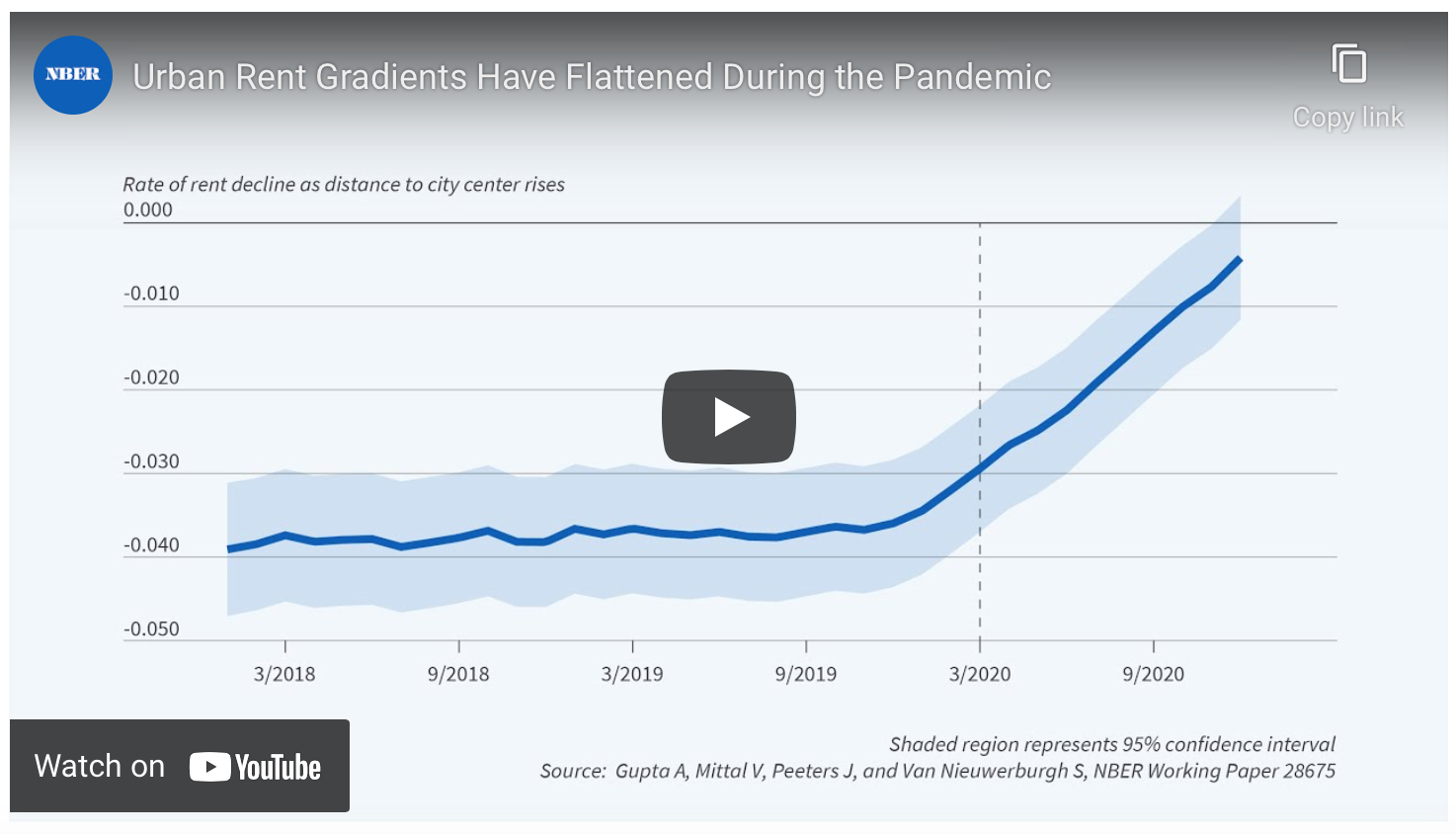

We explore these questions in a recently updated Working Paper with Stijn Van Nieuwerburgh, Vrinda Mittal, and Jonas Peeters; you can see a short presentation of the project below (and another link here). Here, I want to pick up a few of the threads in the paper and think about future trends.

COVID-19: A Permanent or Transitory Shock?

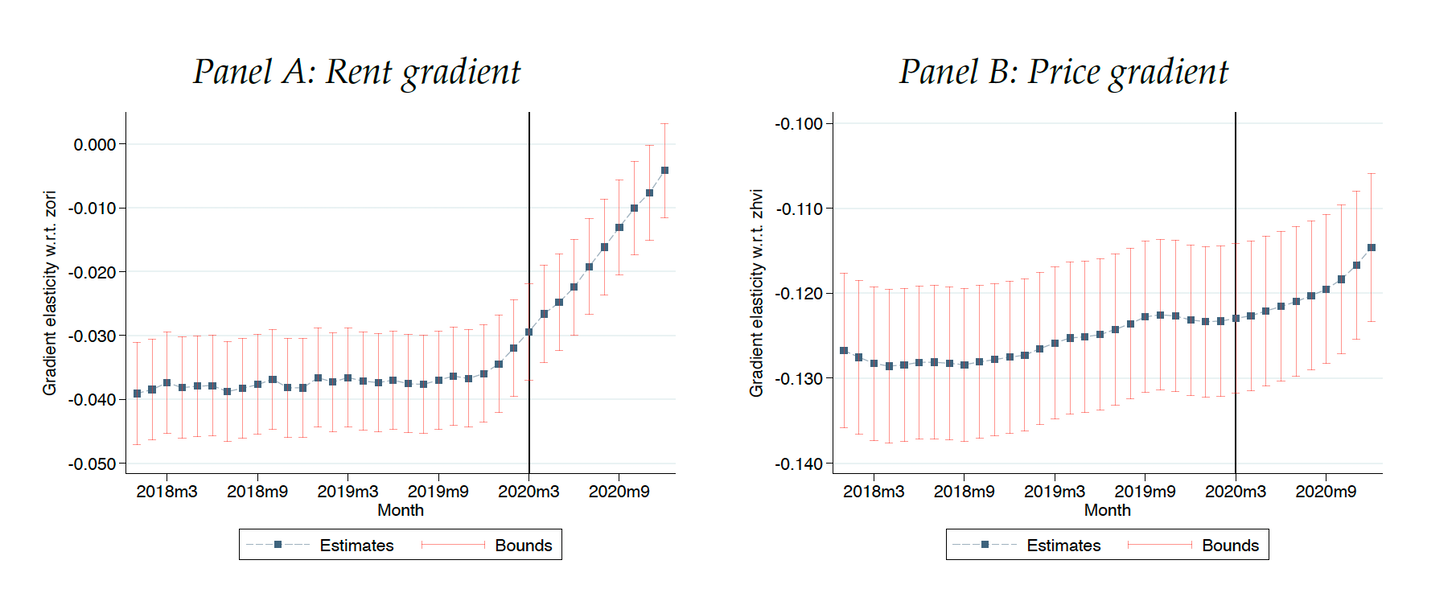

We do a few things to break apart whether the pandemic is transitory or permanent. First we look at rents contrasted with prices. The rental market is a spot market: the inventory clears period-by-period (subject to some vacancy) meeting demand. The housing market is more forward looking, incorporating expectations of future changes.

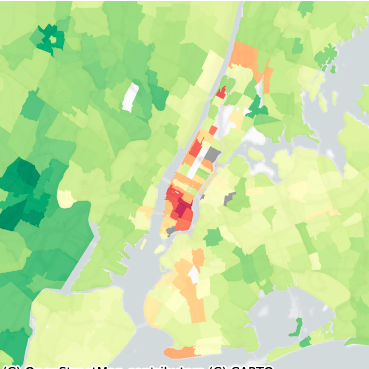

And rental markets have really changed. We look at the rental gradient (or bid-rent curve)—the extent to which being closer to the center of the city carries a premium. This has basically disappeared completely across a sample of 30 MSAs, while the price premium has declined somewhat but not by as much. This tells us the transitory effects of the pandemic are pretty strong, virtually eliminating the premium for urban space in the short-term market, and much higher than the permanent changes captured in prices.

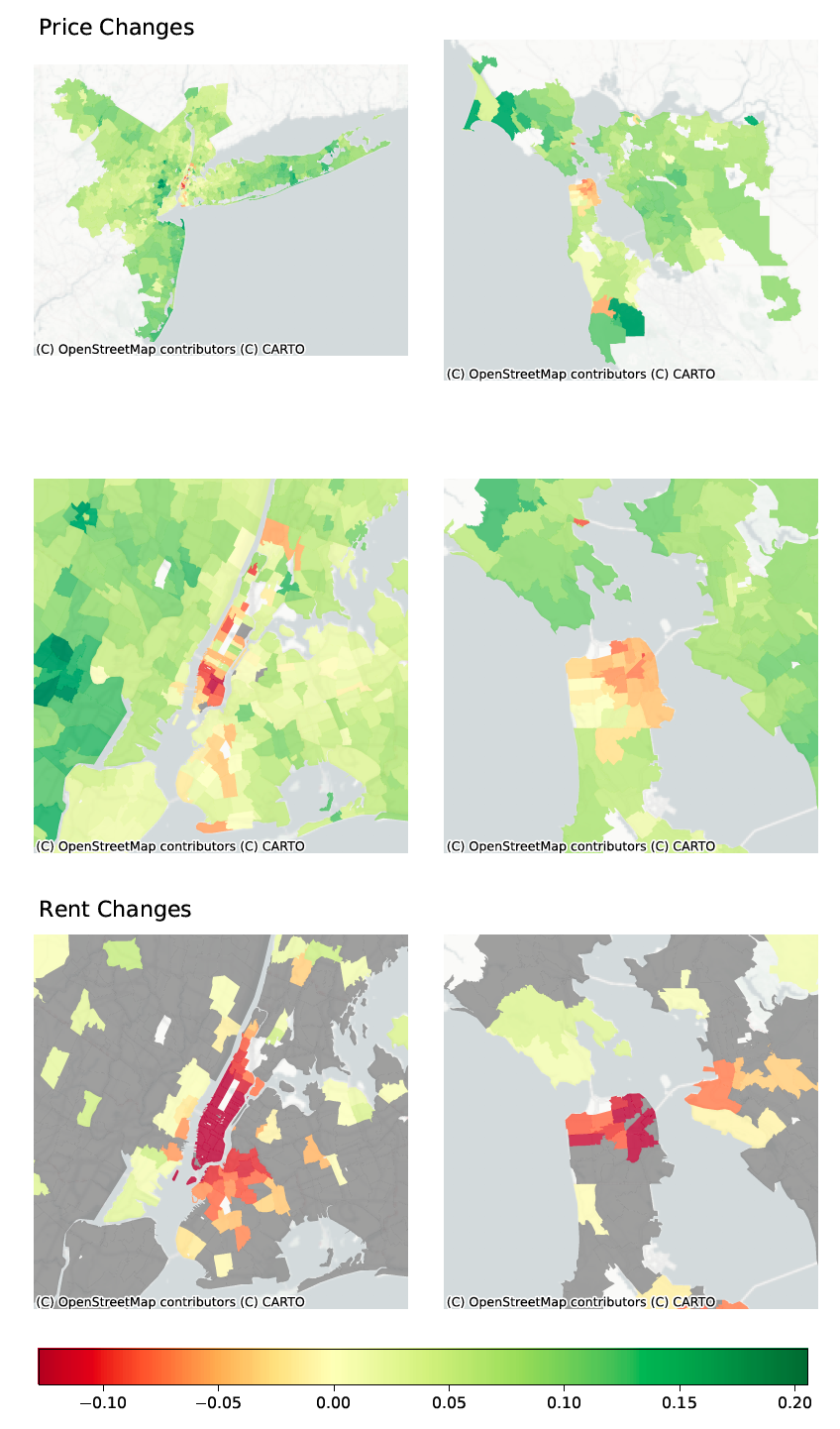

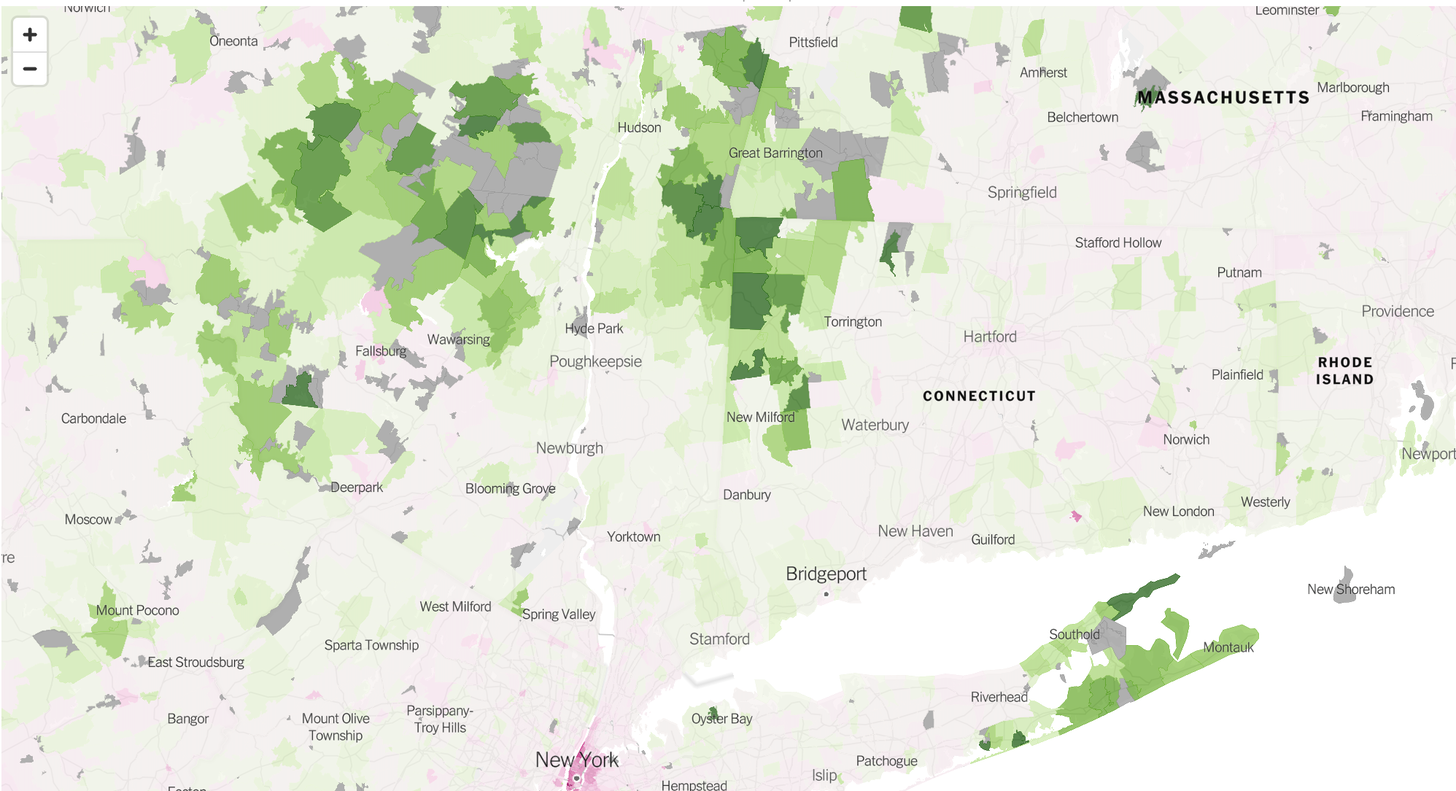

You can get a clear visual sense of these trends by looking at the Bay Area and New York—two of the most affected superstar cities. Prices—but especially rents—are really going down in the urban centers which used to command a large premium; and going up in the wide swath of suburban land around cities.

By the way, this is why there is not really a “puzzle” of rents and prices moving in opposite directions. You see trajectories of urban revaluation across both rents and prices—just much weaker in prices, which reflect the permanent component of revaluation.

In the paper, we also look at survey data on whether this will be a permanent or transitory shock, and estimate the degree of urban recovery. In the context of a Campbell-Shiller decomposition, we estimate that future rents will rise to justify the current level of prices. Cities aren’t dead, but they are temporarily shocked and partially reshaped by remote work.

Remote Work and Cities

When we look at the cross-section—across MSAs; and within cities across ZIP codes—there is one factor which clearly predicts changes in migration and real estate patterns: the share of people who can work remotely.

In general, this could reflect two main things. Remote workers tend to be exactly the sort of highly educated urban professionals who have recently flocked to cities for amenities, and may now be reassessing urban attractions even on a permanent basis. It’s an interesting paradox, as Lukas Althoff, Fabian Eckert, Sharat Ganapati, and Conor Walsh explore, that the people who have packed themselves most densely at the centers of cities are also the same people who could, potentially, do that job remotely.

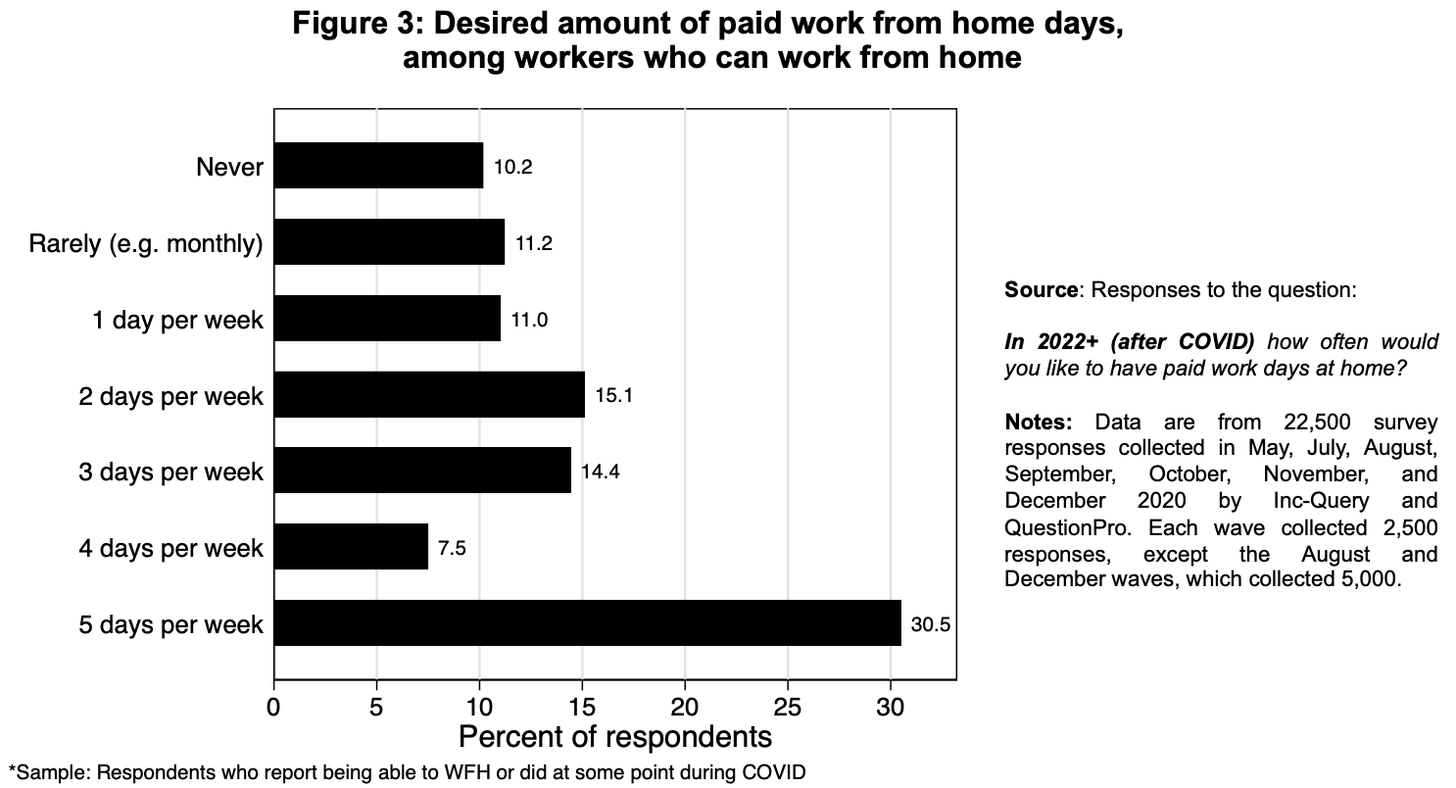

The other channel—and I personally think this is the main one—is that we have had a drastic shift in remote working norms enabling persistent changes in residential location. I draw a lot here from Adam Ozimek and Nick Bloom. Barrero, Bloom, and Davis, for example, have a survey which highlights the importance of the “hybrid” model—30% of workers here want to work remotely all the time (enabling moves outside the MSA), while 10% of people want to be in the office all the time. The remaining 60% of workers envision a future where they will show up to the office some number of days in the week, but not all.

What the hybrid model enables is a resorting of desired residential location within your MSA. If you think you have a fixed commuting budget; you might be willing to spend a little bit longer commuting each way, if you make the trip fewer times a week.

We see evidence of this in a recent NYT piece by Jed Kolko, Emily Badger and Quoctrung Bui; which uses USPS change of address data to track moves. You see big relative change in migration in metros like New York, San Jose, and San Francisco—these areas have the combination of high remote work (opening up the possibility of moving) combined with NIMBYism and supply constraints (high costs, and high incentives to move out).

Within these metro area, we see large migration in the extreme exurban fringes of cities like New York—which are also the same areas where we saw high price changes. Many of these places are actually outside the technical MSA boundary, and were not even really considered commutable before—but that was on the old five-day-a-week schedule. Remote work opens up a broader radius in which you can optimize your housing choices.

Supply Constraints and Agglomeration Economies

This brings up questions about whether these changes in real estate choices are actually good. Cities, after all, are home to all of these great agglomeration economies. Will a more suburban America feature lower growth, if we miss out on all of the great water cooler talk and post-work drinks that fuel innovation?

I think the first-best solution here is clear—just build enough housing in dense, productive cities so people can access affordable housing stock in the cities they work in. The problem is we have made superstar cities, where attractive jobs are located, impossible to build in. Urban economists are inclined to attribute some of the resulting urban premium to people moving to cities in order to access urban amenities, and that’s surely part of the story. But many workers are simply forced to pay high Bay Area and New York City rents to access jobs, which means that rising rents have just eaten up a large chunk of economic gains. In the absence of YIMBY efforts in these cities, increased remote work is a new force which pushes against those economic constraints to open up new working possibilities elsewhere.

I’m ultimately optimistic that firms are going to be able to figure out how to internalize benefits of the agglomerations that happen within-firm. Jamie Dimon, for instance, has been a remote-work skeptic—but is still anticipating a world with 40% less office demand. JP Morgan is projecting just 10% of workers being fully remote, but being able to hot-desk workers who come in only a few days each week. It’s easy to imagine Midtown Manhattan, and other large office centers under the old commuting model, being really badly affected as a result.

The external links across firms are harder to address, because firms don’t face natural incentives to encourage employees to interact with workers from competing firms. Still, I think we need to think harder about what these cross-firm spillovers actually entail. One of my favorite papers here is by Boris Hirsch, Elke Jahn, Alan Manning, and Michael Oberfichtner, who find that a large chunk of the urban wage premium in Germany just reflects more competition in urban areas, and less market power, rather than productivity differences. It’s possible this result generalizes more broadly—in which case a key question is whether firms are going to allow fully remote hiring of workers.

Greater access to high quality jobs all around the country, rather than to just people willing to move to a handful of select metros, would drastically open up pathways for opportunity—and also rebound in the form of increased spending in local communities. My own view is that trend towards greater spatial equality is one we should welcome, even it comes at the cost of intangible agglomeration economies—in part because it would address the problem of communities which have fallen behind and fallen prey to bad information bubbles. But this is not an obvious question.

The one other X-factor I’ll throw in here is crime. In the dark days of American cities in the 1970s and 1980s—they remained cultural hubs and places where young people would gravitate towards. It’s just that many people moved out as soon as they started to have families—and the problem of urban crime was a key part of that. It’s too soon to tell how crime patterns are changing in cities, but the future trajectory there will clearly also determine how cities fare.

Reported By Arpit Gupta , April 21 Arpitrage.com

New! Carroll Gardens Townhouse

Upcoming Open House

By Appointment Only: Thursday, May 6, 2021, 4:00 – 6:00

82 3rd Place Carroll Gardens, New York

BY APPOINTMENT ONLY

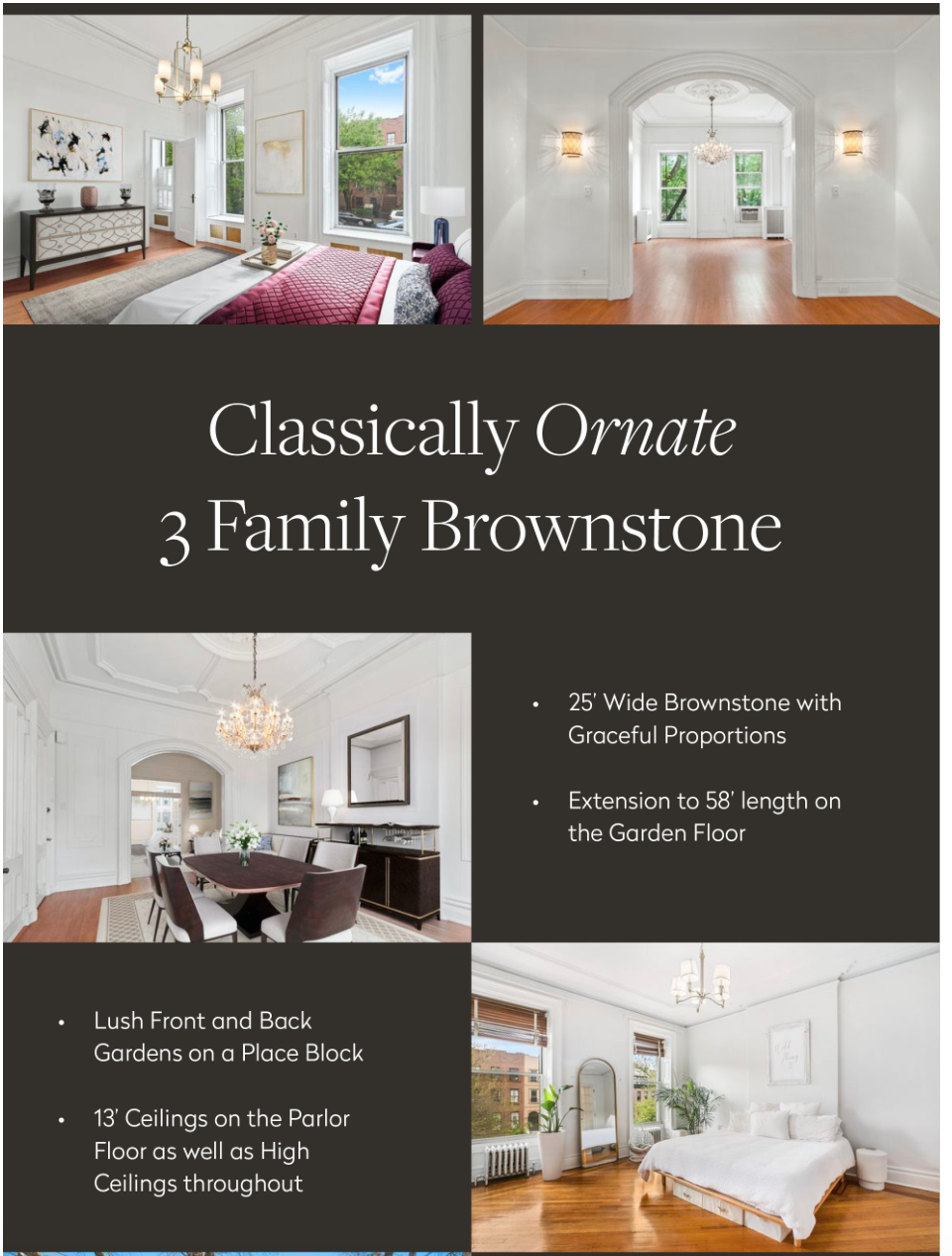

Special details abound in this classically ornate, 25-foot, Carroll Gardens three- family mansion.

Lovingly maintained original details abound throughout the home, located on a prime Carroll Gardens Place block with a large front and back gardens.

The first floor’s thoroughly modern kitchen’s cherry cabinetry and granite countertops add contemporary touches for years of entertaining for the home chef.

A large pantry and washer/ dryer complete this perfect Brooklyn home.

Outside, glass doors open to a charming, paved garden for grilling and relaxing.

French doors from the spacious center living room open to a king-sized bedroom with original shutters and large custom closets.

All bathrooms are brand new, one on each floor.

Beautiful hardware and wide plank oak and parquet flooring throughout show attention to detail which has been given to this home.

The towering parlor floor’s 13 foot ceilings and large windows flood the space with light, highlighting lovely moldings and other classic touches.

Spacious center living rooms with French doors leading into king size bedrooms with custom shutters and built in closets also adorn the two top floor apartments.

A spacious second bedroom or office with windows adorn every floor.

Easily convertible to a single family or use as a two or three family.Zoned for PS 58. Approx 3795 sqft of total living space plus a full basement and considerable FAR to build. Two blocks to the F/G train and CitiBike. Near Frankies 457, Buttermilk Channel, Caputos and all of Carroll Gardens’ best shops.

Listing Details

Carroll Gardens, New York | New Listing | Townhouse | $4,200,000 Price | 7 Beds | 3.0 Baths

Approx. sqft: 3,795 sf | Date Listed: 4/28/2021 | Web ID: 20589136

Info & Amenities | Type: 3 Family House | Rooms: 12.0 |Bedrooms: 7 | Bathrooms: 3.0

NYC’s 10 best under-the-radar picnic spots

Thankfully, with correct social distancing measures, picnics are considered a safe way to have fun this summer, and the city is filled with possibilities in the form of parks and gardens. New York City is also known for its accessible secrets, and our shortlist of urban escapes–whether hidden in plain sight or tucked away–are great to visit any time, but as off-the-beaten-path picnic spots, they shine.

1. The Hallett Nature Sanctuary in Central Park

Enter at 6th Avenue and Central Park South

One of the three woodlands (with the Ramble and North Woods), this section is often referred to as Central Park’s “secret garden.” It was closed off to the public by then-Parks Commissioner Robert Moses in the 1930s for use as a bird sanctuary. As a result, it remained largely untouched until 2001, when the lush four-acre peninsula was reclaimed and tended by the Central Park Conservancy as part of their Woodlands Initiative. The area continues to be a refuge for wildlife, but it’s also a newly-discovered favorite for park visitors seeking a peaceful haven. While the sanctuary is still fenced off, a rustic gate now marks the entrance to new pathways. The Hallett Nature Sanctuary is open daily from 10:00 A.M. until just before sunset; get directions here.

2. The Heather Garden in Fort Tryon Park

Enter near Broadway and Dongan Place

Fort Tryon Park in upper Manhattan extends from 192nd Street and Fort Washington Avenue north to Riverside Drive near 200th Street. Located about 10 minutes from the Cloisters, this lesser-known city escape, designed by the Olmsted Brothers in 1935 for John D. Rockefeller, Jr., is abloom in season with jasmine, hellebores, and daffodils and features one of the largest heather collections in the country. The three-acre garden is also filled with trees, shrubs, and perennials for a botanical diversity that attracts birds, butterflies, and other beneficial wildlife. Perched on a series of slopes more than 200 feet above the Hudson River, the Heather Garden offers stunning views, making it one of the city’s many enchanting spots to enjoy a picnic. Download a map and guide here.

3. Gardens at the Church of Saint Luke in the Fields

487 Hudson Street, West Village

Built in 1821, the Church of Saint Luke in the Fields occupies a two-acre West Village block, with a series of gardens hidden behind high brick walls. Inside, you’ll find the more formal Barrow Street Garden and the older Rectory Garden with wrought iron tables and chairs and an impressive rose garden. You can see the ruins of the old parish, which burned in a fire in 1981, as you wander the paths or take shelter in the garden’s quiet nooks and green spaces. Hours: Monday – Friday 9 A.M. – 5 P.M.; Saturday and Sunday 12 p.M. – 4:00 P.M. Masks must be worn for the duration of the visit.

4. The New York Chinese Scholar’s Garden at Snug Harbor

1000 Richmond Terrace, Staten Island

The New York Chinese Scholar’s Garden in Staten Island’s Snug Harbor Cultural Center and Botanical Garden is one of two authentic scholar’s gardens in the United States and serves as a setting for a variety of multi-cultural events. The garden features magnificent rock sculptures resembling the mountains that inspired the poetry and paintings of Confucian, Buddhist and Taoist monks and other scholars. Visitors can explore eight pavilions, a bamboo forest path, waterfalls, a koi pond, Chinese calligraphy and a variety of Ghongshi scholar’s rocks including a 15-foot formation that towers over the central courtyard. * The Chinese Scholar’s Garden is currently closed due to the COVID crisis–check here for updates.

5. Valentino Pier, Red Hook

Coffey Street at Ferris Street, Brooklyn

The Louis Valentino, Jr. Park and Pier is one of those urban gems that’s perfect just the way it is. A small beach area and benches along the pier offer big views of the Statue of Liberty, Governor’s Island, the Manhattan skyline, Staten Island, and New York Harbor. Well-tended green space adjacent to the pier is perfect for picnics.

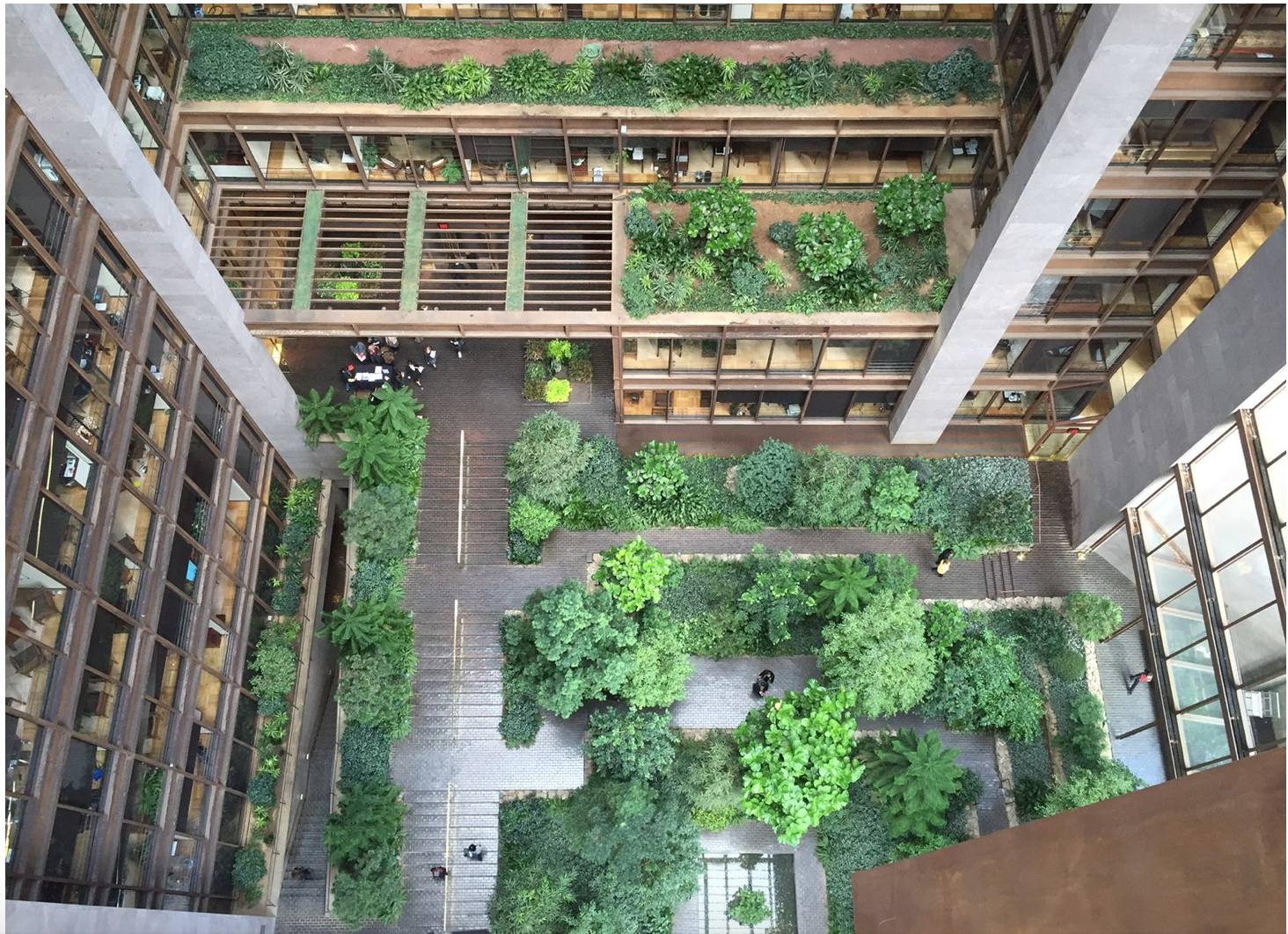

6. The Ford Foundation Atrium

320 East 43rd Street, Midtown

Not all of the city’s lush, green picnic picks are outdoors. If you’re in need of a rainy-day alternative, you can enjoy lunch in a tropical garden paradise encased in a 10-story glass atrium. At this privately-owned public space, ferns and hanging vines drape from the building’s girders and the scent of gardenias and the sound of water filling a pool hidden amid a cluster of trees fill the air. The building’s glass walls create a temperate environment ideal for the atrium’s subtropical garden while creating a seamless flow of green space between the atrium and Tudor City Park to the east. * The Ford Foundation and its garden are currently closed due to the COVID crisis–check here for updates.

7. Brooklyn Bridge Park’s Pier 2 Uplands

Enter off Clark Street

The most recent addition to Brooklyn Bridge Park, the Uplands at Pier 2 is a 6,300-square-foot lawn with stunning Manhattan skyline views. It boasts nearly 1,300 new trees and shrubs, a new water play area made up of salvaged pieces of Pier 3, seating made of granite from the Brooklyn Bridge, and a noise-reducing berm to ensure your picnic is peaceful. Pier 2 is open daily from 6 am to 8 pm.

8. Creative Little Garden

530 East 6th Street, East Village

No list of lesser-known picnic spots would be complete without mention of the magical East Village gardens. Of these, the Creative Little Garden may not be the best-known but it may be the most enchanting. This elegant shade garden first got its lease in 1978. Long and narrow, it winds around a gravel path, rock garden, flagstone patio, and many seating areas. Quiet evening concerts happen on the regular, but it’s always possible to find a nook to hide in. * Note that some community gardens may remain closed due to the COVID Crisis–check here for updates.

9. 6BC Community Garden

622 East 6th Street between Avenues B and C, East Village

This Alphabet City community garden is one of the neighborhood’s larger public gardens, and it’s a joy to discover its secret spaces just steps from the bustling East Village scene. * Note that some community gardens may remain closed due to the COVID Crisis–check here for updates.

10. Ridgewood Reservoir

Highland Park, Ridgewood, Queens

Highland Park and the 50+ acre Reservoir sit atop the Harbor Hill Moraine, an ice-age-formed ridge, which means you get dramatic views of nearby cemeteries, East New York, Woodhaven, the Rockaways and the Atlantic Ocean. The famous Olmsted brothers designed the main drive and concourse on the southern portion of the Reservoir, which operated as a water supply for Brooklyn from 1858 to 1959. It is divided into three basins separated and enclosed by steep stone walls. The outer basins were drained decades ago; what you’ll find is the way nature overtakes a landscaped space if given the chance: The combination of forests, fields, and wetlands make this a uniquely ideal spot wildlife viewing. 127 bird species were recorded on its grounds along with opossum, raccoon, squirrels, voles, snapping turtles, garter snakes, and frogs.

Editor’s Note: This story was originally published on August 6, 2018, and has been updated

As reported by 6sqft.com POSTED ON TUE, JULY 7, 2020

COVID-19, One Year Later: Pandemic created NYC rental crisis, but hope abounds for both relief and a real estate rebound

With the city practically shutting down at the start of the COVID-19 pandemic, tens of thousands of renters lost their jobs and found themselves unable to pay their rent. The entire real estate industry, meanwhile, found itself in flux as well — as thousands headed out of the city, leaving plenty of vacancies and no one to fill them.

At the start of 2020, renters rejoiced at the news that broker fees for prospective tenants who did not go through a broker had been banned. The ban was a part of two bills, New York State passed two acts that were designed to help renters: Housing Security & Tenant Protection Act of 2019 and the Housing Stability & Tenant Protection Act of 2019, which were meant to protect the rights of renters.

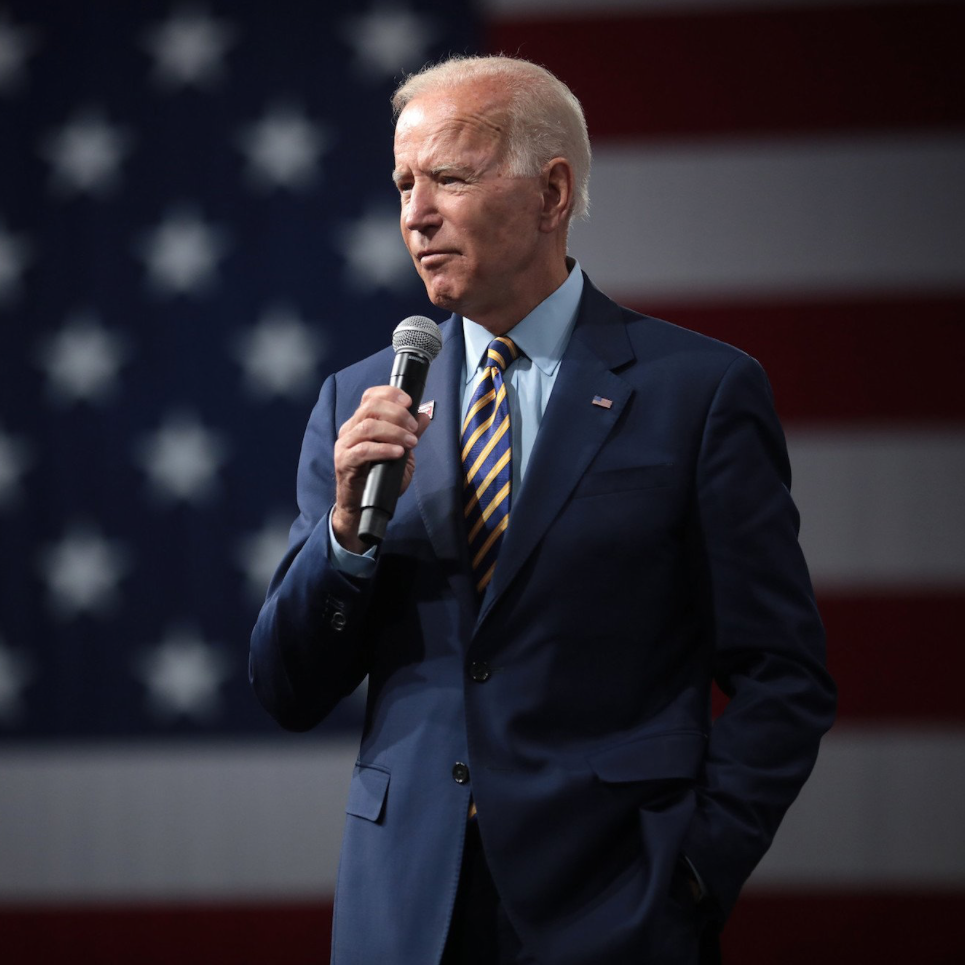

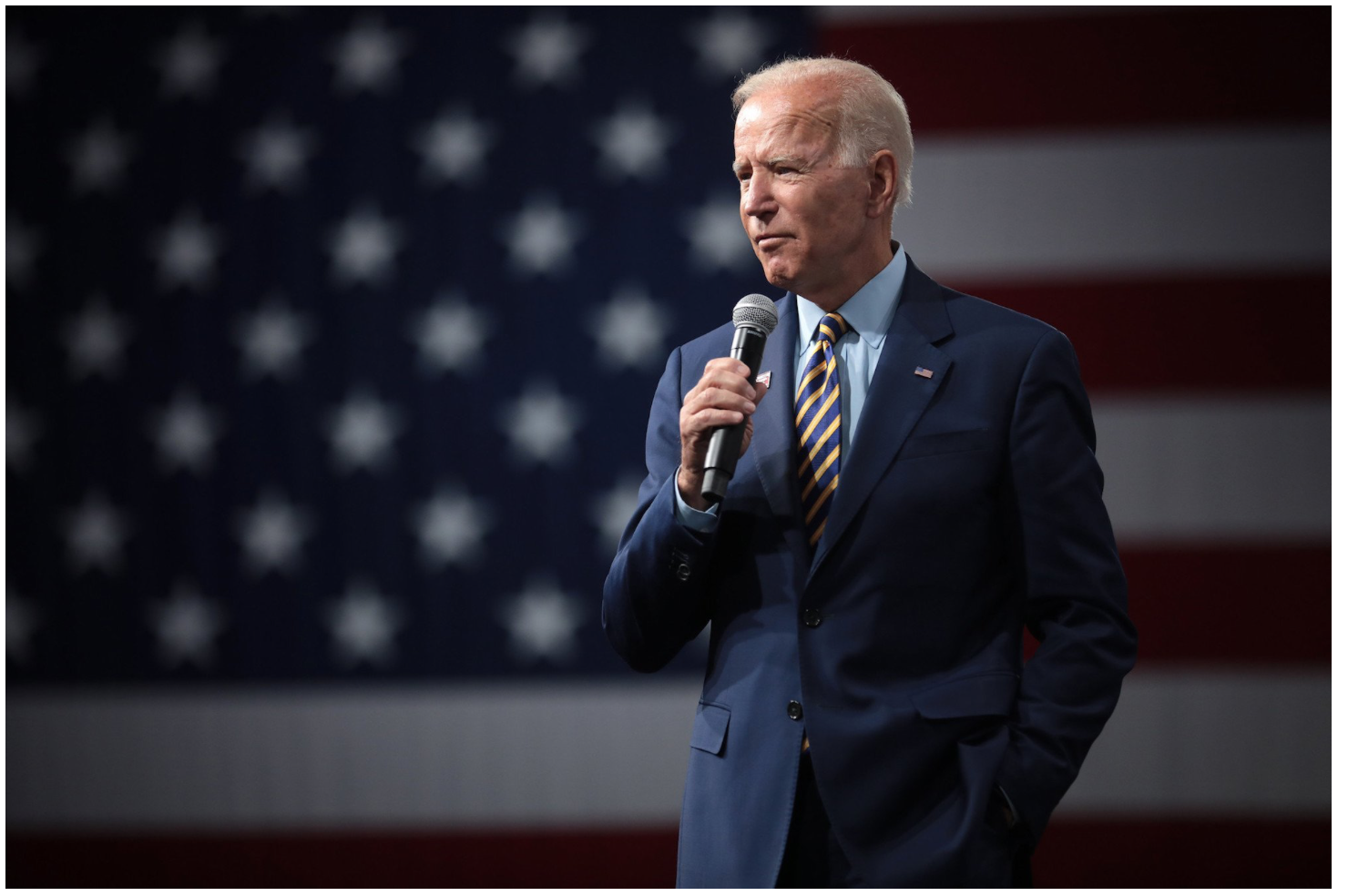

How Joe Biden will affect NYC’s renters, real estate, and recovery

After Joe Biden is sworn in as the 46th president of the United States on Wednesday, his immediate focus will be getting the coronavirus pandemic under control and providing direct relief to Americans. In addition to immediate actions related to COVID-19, Biden’s Day 1 housing priorities include extending the federal nationwide moratorium on residential evictions through the end of September and sending an additional $25 billion in rental assistance to states. Down the road, Biden has proposed fewer developer-friendly policies than his predecessor, including a repeal of the 1031 exchange and reform of the Opportunity Zone tax program. But overall, there is optimism among New York City real estate industry experts who see a Biden Administration as a way to restore stability and consumer confidence. With a pledge to defeat COVID-19 and send federal support to New York City, there’s hope on the horizon for the city’s recovery.

After Joe Biden is sworn in as the 46th president of the United States on Wednesday, his immediate focus will be getting the coronavirus pandemic under control and providing direct relief to Americans. In addition to immediate actions related to COVID-19, Biden’s Day 1 housing priorities include extending the federal nationwide moratorium on residential evictions through the end of September and sending an additional $25 billion in rental assistance to states. Down the road, Biden has proposed fewer developer-friendly policies than his predecessor, including a repeal of the 1031 exchange and reform of the Opportunity Zone tax program. But overall, there is optimism among New York City real estate industry experts who see a Biden Administration as a way to restore stability and consumer confidence. With a pledge to defeat COVID-19 and send federal support to New York City, there’s hope on the horizon for the city’s recovery.

The real estate developer-in chief has left the White House. What will change under President Biden?

Biden is expected to roll back and reform a number of programs under President Trump’s 2017 Tax Cuts and Jobs Act (TCJA). This could include raising the corporate tax rate back to 28 percent after it was lowered to 21 percent under the legislation and raising taxes on individuals earning over $400,000.

The TCJA also implemented a $10,000 cap on deductions of state and local taxes, or SALT. Democrats, especially from high-tax states like New York, New Jersey, and Connecticut, want to remove the cap, which they see as a politically-motivated way to raise revenue to offset the costs of tax cuts made in other places under the bill.

In 2018, Gov. Andrew Cuomo joined a multi-state lawsuit against Trump’s SALT cap, claiming the program is a way to raise taxes in predominantly Democratic states. A judge dismissed the suit the following year, but it is being heard by the 2nd U.S. Circuit Court of Appeals. “New York is already the nation’s leader in sending more tax dollars to Washington than we get back every year, and we will not allow this administration to pick the pockets of hard-working New Yorkers to fund tax cuts for corporations and send even more money to red states,” Cuomo said in a 2019 statement.

According to a report released last May by the state’s Rockefeller Insitute of Government, the total economic activity lost as a result of the SALT cap ranges between $14.4 billion and $24.5 billion, prior to the pandemic. And because of the higher housing prices and incomes in New York City compared to the rest of the state, housing prices dropped by 1.5 percent in the NYC Metro Area as a result of the cap, according to the report.

Sen. Chuck Schumer, now the Senate’s majority leader, has been a leading voice for repealing the SALT cap and proposed last year for it to be included in a coronavirus relief bill (it wasn’t). “We need to cushion the blow of this virus,” Schumer said during a press conference last summer, as The Hill reported. “The SALT cap hurts people affected by the virus. It hurts so many of the metropolitan areas like New York.”

Biden has also proposed repealing the 1031 exchange, a provision in the tax code that allows developers to defer taxes on investment properties if the capital gains are reinvested in a similar property, for real estate investors making over $400,000 in annual income. The current exchange allows real estate investors to shift investments while avoiding the need to pay a significant amount in taxes. By repealing it for certain high earning investors, revenue could be raised for other proposed programs.

The next administration is looking to reform the Opportunity Zone tax program, which gives developers tax breaks for investments made in low-income areas. According to Biden’s team, the program is not currently meeting its goal of spurring development and job growth in communities of color. His website cites a June 2020 report from the Urban Insitute that says a majority of Opportunity Zone projects are focused on “real estate transactions, not direct investments in operating businesses.”

There are 306 census tracts across the five boroughs that are designated as Opportunity Zones. According to the Citizens Housing Planning Council, 4 out of 10 housing units inside the zones are rent-stabilized and others are allocated in public housing complexes; 40 percent of the New York City Housing Authority’s 325 developments fall within an Opportunity Zone.

Some housing experts have expressed concern that the program could drive displacement of residents and encourage gentrification, all without a proper regulatory system in place. To reform the program, Biden wants to make projects in these zones have a community-based organization as a partner, increase oversight to make sure there are clear benefits to the designated areas, and make it more transparent by requiring those receiving a tax break to provide detailed reports and public disclosure on their investments and the impact on the local residents.

And last year, Trump repealed the Affirmatively Furthering Fair Housing rule, a 2015 law that required local governments receiving federal housing financing to examine housing patterns and identify and address policies that have a discriminatory effect. Biden plans to reinstate the rule.

Rental assistance and a moratorium on eviction and foreclosures are on Biden’s Day 1 agenda.

There are actions Biden has pledged to pursue immediately upon taking office on Wednesday. Under his $1.9 trillion “American Rescue Plan,” which creates a national vaccination program, sends additional stimulus checks, extends unemployment insurance, and provides funding for state and local governments, New York could receive about $54 billion in federal funding.

Biden said he will call for the current Centers for Disease Control and Prevention’s nationwide moratorium on evictions and foreclosures, set to expire at the end of the month, to be extended until September 30, 2021. This goes further than the freeze put in place by Gov. Andrew Cuomo, which was first enacted in March and extended last month through May. Other rent relief measures issued by the state include allowing renters to use their pre-paid security deposit for rent and banning fees for late payments. As many as 1.2 million families in New York are at risk of eviction, according to the New York Times.

Biden also wants to continue applications for forbearance on federally-guaranteed mortgages through the end of September and provide funds for legal assistance for households facing eviction or foreclosure.

As part of the second stimulus package signed by Trump last month, $25 billion in rental assistance was allocated to states, with New York receiving roughly $1.3 billion. “While the $25 billion allocated by Congress was an important down payment on the back rent accrued during this crisis, it is insufficient to meet the scale of the need,” the memo from Biden’s team reads.

He is calling for an additional $25 billion in assistance especially for “low- and moderate-income households who have lost jobs or are out of the labor market,” according to the plan. Biden proposes another $5 billion to cover home energy and water costs and outstanding bills of struggling renters through programs like the Low Income Home Energy Assistance Program.

What about landlords?

New York property owners want to be included in the conversation about the city’s recovery. Landlord groups have pushed for a rent voucher program, similar to Section 8, that would pay landlords directly, instead of canceling rent or extending the freeze on evictions. Joseph Strasburg, president of the Rent Stabilization Association, New York’s largest landlord advocacy organization, said President Biden’s relief package should include funding specifically for rent vouchers.

“President Biden’s reportedly $50 billion economic relief package to New York won’t be enough if it doesn’t earmark dollars specifically for a need-based, rent-voucher superfund for families that are unable to pay their rent due to health and financial hardship related to COVID-19,” Strasburg said in a statement to 6sqft.

“Like federal Section 8 and other government subsidies, rent-vouchers would be used only for rent payments. This wouldn’t be a bailout for landlords, but rather it would preserve housing, keep families in their homes, and prevent the financial collapse of New York City.”

Strasburg also argues that a voucher would help landlords pay their property taxes, which make up about half of the city’s tax revenue. Mayor Bill de Blasio last week announced that the city’s property tax revenues are expected to drop by $2.5 billion, the largest decline in nearly three decades.

“Rent vouchers would enable thousands of landlords – already standing on the ledge of tax default – to pay their property taxes,” Strasburg said. “In turn, the city would be able to maintain essential services and prevent layoffs of teachers, hospital workers and other essential employees – not to mention saving neighborhood economies and the thousands of jobs that depend on the food chain of landlords repairing and maintaining their buildings and paying water, heating and other bills.”

For the long-term, a comprehensive housing plan that sees housing as a right, not a privilege.

During his presidential campaign, Biden laid out a sweeping 10-year, $640 billion housing plan that centers around the idea that housing is a right, not a privilege. The plan, which will be led by Rep. Marcia Fudge if approved by the Senate to lead the U.S. Department of Housing and Urban Development, includes a $100 billion affordable housing fund to construct and upgrade developments, an expansion of the Section 8 housing voucher program to reach every eligible family, creation of a First Down Payment Tax Credit to help families buy their first home, and enaction of a renter’s tax credit to lower rent for low-income families who don’t qualify for Section 8.

Included in the plan is a comprehensive strategy to end homelessness, which includes the passage of Rep. Maxine Waters’ Ending Homelessness Act. The five-year $13 billion bill funds a “holistic” approach to ending homelessness in the country with the goal of creating 400,000 additional housing units for those experiencing homelessness, particularly children and young adults.

But the plan does not explicitly address investment in public housing, which will be critical for the New York City Housing Authority. Gregory Russ, the chair of NYCHA, estimated that the agency now needs $40 billion in capital to repair the thousands of public housing units that are home to more than 400,000 New Yorkers.

With the coronavirus vaccine here and federal funding on the way, there’s hope for the recovery of NYC’s real estate industry.

Because of COVID-19 and the anxiety surrounding the presidential election, it was a rough year for real estate in New York City, with residential sales plummeting by 40 percent in July and 57 percent in August compared to last year, according to a report from Comptroller Scott Stringer’s office and average rents still down.

But following the election of Biden last year, the market in Manhattan saw a “post-election” bump in November and December, according to a report from SERHANT. In Manhattan, 927 sales contracts were signed in November, an increase of 5.1 percent compared to last year, and 802 contracts were signed in December, a year-over-year increase of 8.4 percent.

“While it is still too early to tell, if this trend holds, we may be looking at a robust 2021,” Garrett Derderian, director of market intelligence at SERHANT, said earlier this month in a press release.

Derderian added: “At this point, it is safe to say the notion that ‘everyone is fleeing the city’ is outdated. People did leave, but that happened in the spring and early summer – and many who left were renters. Now we see buyers returning, eager to take advantage of falling prices. Your dollar goes a lot farther than it used to. If you are looking to negotiate for that once-in-a-lifetime deal, now may be the best time.”

While it’s unlikely the NYC market will return to “normal” any time soon, real estate experts see a Biden presidency as a way to restore stability and security. Plus, the arrival of the COVID-19 vaccine, despite its sluggish rollout, provides hope for the city’s broader recovery, according to Noemi Bitterman, a real estate agent with Compass.

“We’re going to have stability. We’re going to have someone that has an administration of men and women that we not only support but respect,” Bitterman told 6sqft. “They give us that confidence and credibility that we’ve been missing all of this time.”

As part of his emergency recovery plan, Biden plans to provide much-needed funding to state and local governments and $20 billion in relief to “hardest hit transit agencies” which no doubt includes the Metropolitan Transportation Authority, currently facing its worst financial crisis in history. Funding for the MTA and transit projects, including the crucial Gateway Program, is seen as necessary for New York City and its economy to recover.

“Once things calm down–which they will–people will be back,” Bitterman said. “The job opportunity, the culture, the vibe of New York City, you can’t duplicate that anywhere else.”

By 6sqft POSTED ON WED, JANUARY 20, 2021

BHS The Line Update with Greg Heym, Chief Economist.

Good Morning!

Today we’ll look at the latest on unemployment claims and retail sales.

1

Initial Claims for Unemployment Rise to 855,00

Last week, 885,000 new jobless claims were filed, up from a revised 862,000 the prior week. Economists were expecting this number to decline to 808,000, so this is disappointing news. The 885,000 claims are also the most since the week of September 5.

The lone bit of good news in the report was the continuing unemployment claims fell by 273,000 to 5.5 million.

2

Retail Sales Fall for the Second Straight Month

2

What Does the Data Tell Us About the Economy

The recovery is slowing. Rising unemployment claims and declining consumer spending are reflecting the impact of increased virus cases and subsequent lockdowns, and the lack of a new stimulus package. Since consumer spending is roughly 70% of GDP, this data is concerning.

The good news is these factors will be temporary. With vaccinations starting this week, it’s just a matter of time before the virus is under control. I understand that vaccinations will not happen fast enough to prevent further lockdowns, like the one New York faces in the coming weeks. But I’m confident if NY does shut down, it will be for a few weeks instead of months.

There is also hope on the stimulus front, let’s hope they finally get it done.

Here is some good news to start your weekend off, mortgage rates fell to yet another record low this week.

Have a great weekend.