The program, similar to mandates issued in France and Italy last month, will start on Aug. 16, and after a transition period, enforcement will begin on Sept. 13, when schools are expected to reopen and more workers could return to offices in Manhattan. Mr. de Blasio has been moving aggressively to get more New Yorkers vaccinated to curtail a third wave of coronavirus cases amid concern about the spread of the Delta variant. He is also requiring city workers to get vaccinated or to face weekly testing, and he has offered a $100 incentive for the public.

“If you want to participate in our society fully, you’ve got to get vaccinated,” he said at a news conference. “It’s time.”

“This is going to be a requirement,” he added. “The only way to patronize these establishments is if you are vaccinated, at least one dose. The same for folks in terms of work, they will need at least one dose,” he said, holding up a single finger.

On Monday Mr. de Blasio stopped short of reinstating an indoor mask mandate even as large urban areas, including Los Angeles County, San Francisco and Washington, and at least one state did so. He said he wanted to focus on increasing vaccination rates, and was concerned that requiring everyone to wear masks would remove an incentive for those who are considering getting vaccinated now.

Nationally, new cases have reached an average of about 86,000 a day as of Monday, a dramatic jump from about 13,000 daily cases a month ago but still far fewer than in January. Hospitalizations have risen as well, but hospitalizations and deaths remain a fraction of their devastating winter peaks.

About 66 percent of adults in the city are fully vaccinated, according to city data, although pockets of the city have lower rates. The federal government has authorized three vaccines for emergency use in the United States: The Pfizer-BioNTech and Moderna vaccines both take two doses while Johnson & Johnson uses a single dose. Individuals are not considered to be fully vaccinated until two weeks after their final dose.

Fully vaccinated people are protected against the worst outcomes of Covid-19 caused by the Delta variant, but there’s a sharp drop in the efficacy if an individual has only had one dose of a two-dose vaccine.

The new program, dubbed “Key to NYC Pass,” is not a particular document, but rather the strategy of requiring proof of vaccination for workers and customers at indoor dining, gyms, entertainment and performances, including Broadway, the mayor said.

Indoor movies and concerts will also require people to show proof of vaccination to enter. People will be able to continue to dine outdoors without showing proof of vaccination.

To enter indoor venues, patrons must use the city’s new app, the state’s Excelsior app or a paper card to show proof of vaccination. The mayor did not say how the city will handle vaccinations like AstraZeneca or Sinovac that may be common among international tourists.

Children younger than age 12 will not be excluded from venues because they are not eligible to be vaccinated, he said. But the details of those plans remain to be worked out. “We have to figure out how to do things in a safe manner,” the mayor said.

The city will issue a health commissioner’s order and a mayoral executive order to put the vaccine mandate in place. The six weeks before enforcement begins on Sept. 13 will be spent educating businesses and doing outreach, he said.

The mayor said the city consulted with the U.S. Department of Justice and got a “very clear message” that it was legal to move forward with these mandates, even without full F.D.A. approval.

Only people fully vaccinated in the state of New York can get an Excelsior pass, which confirms vaccination against city and state records. Everyone, however, can use the city’s new app, NYC Covid Safe, because it is simply a digital photo album that stores a picture that a person takes of their own vaccination card and does not double check it against any registry. A paper card from the Centers for Disease Control and Prevention must always be accepted, too.

Emma G. Fitzsimmons is the City Hall bureau chief, covering politics in New York City. She previously covered the transit beat and breaking news. @emmagf

Sharon Otterman has been a reporter at The Times since 2008, primarily covering education and religion for Metro. She won a Polk Award for Justice Reporting in 2013 for her role in exposing a pattern of wrongful convictions in Brooklyn. @sharonNYT

Joseph Goldstein covers health care in New York, following years of criminal justice and police reporting for the Metro desk. He also spent a year reporting on Afghanistan from The Times’s Kabul bureau. @JoeKGoldstein

This holiday season, explore Brooklyn Botanic Garden like never before at the after-dark, illuminated spectacular Lightscape. Join with family and friends to celebrate the beauty of nature in winter on this enchanting trail animated by a curated soundtrack and over one million dazzling lights.

This holiday season, explore Brooklyn Botanic Garden like never before at the after-dark, illuminated spectacular Lightscape. Join with family and friends to celebrate the beauty of nature in winter on this enchanting trail animated by a curated soundtrack and over one million dazzling lights.

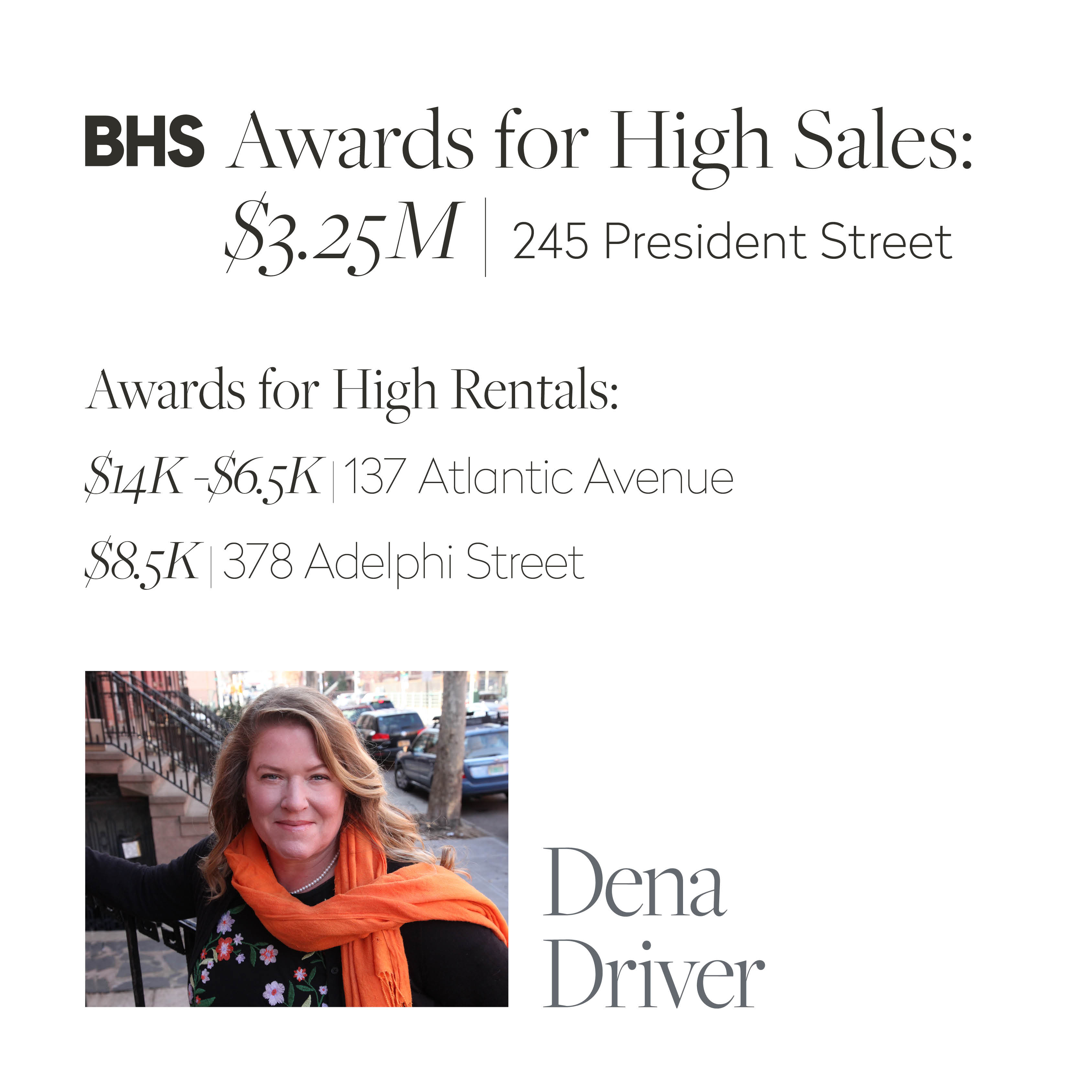

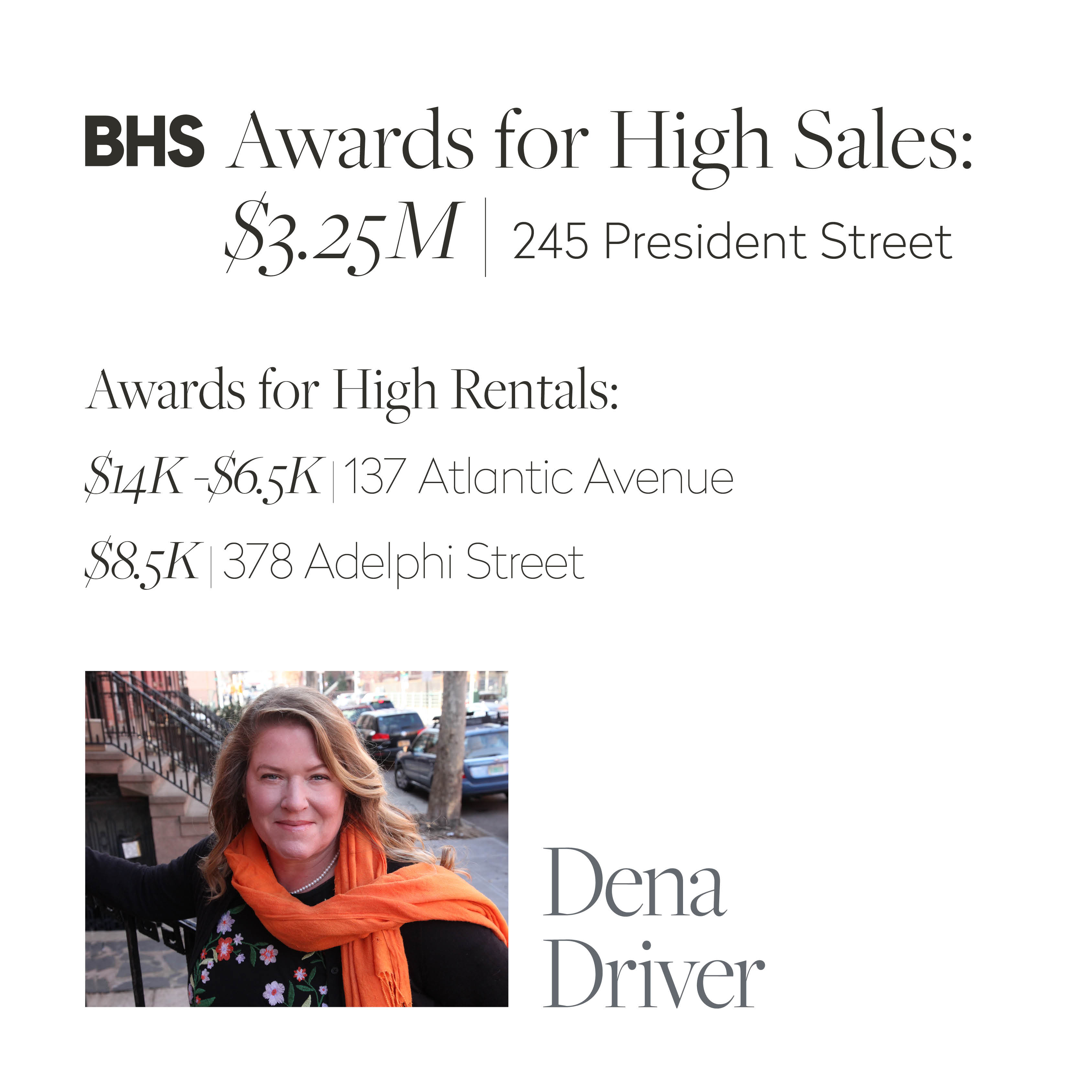

378 Adelphi Street was built in 1858 by Jeptha A. Jones a compositor and hardware store owner. During the Civil War he was a Captain in the Union army. He was wounded at Bull Run, re-enlisted and fought until 1863. He was called “The Walker” because in battle he led his men with a slow, steady pace. Jones survived the war and is buried in Greenwood Cemetery.

378 Adelphi Street was built in 1858 by Jeptha A. Jones a compositor and hardware store owner. During the Civil War he was a Captain in the Union army. He was wounded at Bull Run, re-enlisted and fought until 1863. He was called “The Walker” because in battle he led his men with a slow, steady pace. Jones survived the war and is buried in Greenwood Cemetery.

The majority of millennials don’t own a home — and many say their student loans are a major reason for that. According to a

The majority of millennials don’t own a home — and many say their student loans are a major reason for that. According to a