NEW YORK (Reuters) – U.S. mortgage application activity decreased to its lowest in 2-1/2 years last week as loan requests to refinance an existing home fell to their weakest level since December 2000, the Mortgage Bankers Association said on Wednesday.

The Washington-based group’s seasonally adjusted index on weekly home loan requests fell 3 percent to 342.5 in the week ended Aug. 3. This was the lowest reading since 328.6 in the week of Jan. 1, 2016.

The decline in home refinancing could be a future drag on domestic consumer spending. Homeowners refinance their homes either to reduce their monthly mortgage payments or to extract cash from the values of their homes.

So far, the drop in refinancing due primarily to higher mortgage rates has yet to hurt household expenditures.

MBA’s barometer on mortgage applications for refinancing declined by 4.5 percent to 927.6 last week, which was its lowest in more than 17-1/2 years.

The share of refinancing fell to 36.6 percent of total applications from 37.1 percent the week before. It held above 34.8 percent set in July, which was its smallest share since August 2008.

Interest rates on 30-year fixed-rate “conforming” home loans, whose balances are $453,100 or less, averaged 4.84 percent, unchanged from a week earlier but up from 4.22 percent at the end of 2017, MBA said.

Most mortgage rates MBA tracks were lower than the previous week.

Meanwhile, MBA’s measure on loan applications to buy a home, a proxy on future housing activity, fell 2 percent to 233.1 in the latest week, which was the lowest since 225.5 in the week of Feb. 16.

Home sales and construction have softened in recent months as a result of rising borrowing costs, tight housing inventories and expensive home prices.

(Reporting by Richard Leong; Editing by Frances Kerry)

Category: Featured

Price reduced. Cobble Hill short term rental.

124 Kane Street. Apt 3 Cobble Hill

Furnished apartment available for short term lease starting July 1st -one month minimum.

Make the tree lined streets of Cobble Hill your summer home. This lovely, well laid out 3rd floor apartment is just two flights up. It has high ceilings and a large open plan kitchen. Six windows bring light in from the north and south. Vaulted high ceilings open up into the living room. Two full bedrooms both have nice closet space. A new bath and extra storage make this apartment a real value for the area. Window A/C is provided.

Zoned for PS 29. Great access to the Brooklyn Bridge Park, fabulous local restaurants like Watty and Meg, Gersi and Pok Pok plus wonderful shops and Trader Joes.. F/G 2/3 4/5 & R subway trains are all in walking distance. Close to all the great restaurants and shops in Cobble Hill and Carroll Gardens.

Price: $2850| Rental | Rooms: 4 | Bedrooms: 2 | Bathrooms: 1

Call today or send me a message on my contact me page today.

Lots of light! 3 Bedroom Carroll Gardens.

237 Carroll Street. Apt 4 Carroll Gardens

Price: $4950| Rental | Rooms: 7 | Bedrooms: 3 | Bathrooms: 2 | Approx Sq Ft: 1250

Carroll Gardens 3BR 2Bth Filled w Light! This rambling top floor rental has a huge skylight and 6 windows overlooking Carroll Park and the Manhattan sky line. This apartment has been completely renovated with brand new kitchen and lovely large baths. Great closet space and a washer dryer. Only a half block walk to the Carroll St F/G. Close to all the great restaurants and shops in Carroll Gardens and Cobble Hill. Available August 22nd.

Call today or send me a message on my contact me page today.

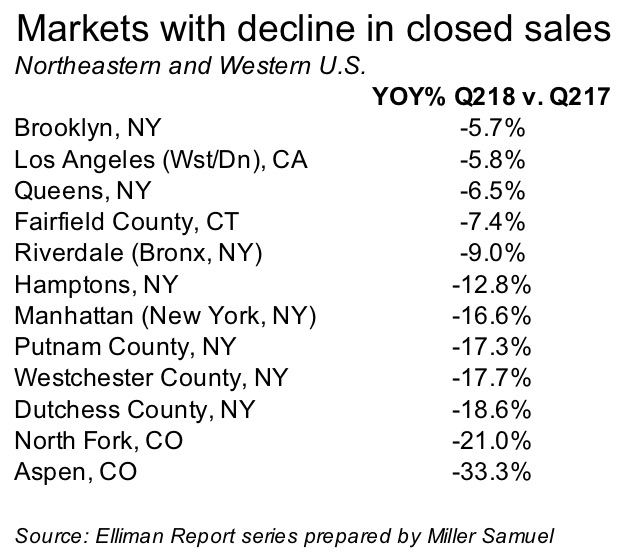

We Have Officially Arrived At A Moment In Housing Nationwide

We Have Officially Arrived At A Moment In Housing Nationwide – Yes according to Miller Samuels

Two different markets show the same trend for somewhat different reasons:

- High-cost markets seeing a slowdown in sales due to the uncertainty of the impact of the December 22, 2018, federal tax law as it relates to the housing market.

- The balance of the U.S. market has crossed an affordability threshold after years of rising housing prices, years of chronically short inventory levels, years of nominal wage growth and now…rising mortgage rates. There is buyer fatigue out there and more are starting to take a break from the merry-go-round until more certainty returns. Here’s the relevant news feed on this:

— Southern California home sales crash, a warning sign to the nation [CNBC] — U.S. New-Home Sales Dropped in June [WSJ] — Existing-Home Sales Slide, Thanks to Soaring Prices [Realtor.com]

Brooklyn Heights Is Getting A Permanent Public Pool

by on Jun 7, 2018

Brooklyn Bridge Park will be creeping further up into Brooklyn Heights with its newest addition: a public pool in Squibb Park, which sits between Brooklyn Heights and Brooklyn Bridge Park (behind that large hotel/condo development). Squibb Park is not widely used—it’s a large concrete area furnished with just a few benches and a public bathroom; it’s mostly accessed to get to the pedestrian bridge.

While Squibb Park isn’t technically part of Brooklyn Bridge Park, we’re told that “subject to necessary approvals, NYC Parks intends to enter into an agreement with BBP for the development, operation, and maintenance of a pool and optional related amenities at Squibb Park.”

This morning BBP will publicly announce plans to build a permanent swimming pool in Squibb Park, though not all details have been ironed out yet. Here’s what we do know:

- Like all NYC Parks pools, this pool will be free and open to the public.

- There will be community planning sessions for the purpose of gathering feedback from the public. This input will inform the design of the pool, including size and capacity.

- Will there be an other amenities? “We want the community to help us determine a number of things during the public planning sessions,” a rep for BBP told us, including what type of non-swimming activities should be included, and if there should there be a concession.

- The timeline on construction and opening is unclear, first there will be a fundraising campaign and those aforementioned community planning sessions.

- The current pop-up pool at Pier 2 will close down after this season. This is because Brooklyn Bridge Park will break ground on the Pier 2 Uplands project this fall.

- The new pool’s hours will likely operate under the pop-up pool hours: between 10 a.m. to 6 p.m. daily.

Construction of the pool is estimated to cost between $10-$15 million. One-third of that will be funded by BBP; Midtown Equities and Alloy Development with Monadnock Construction, and DLJ Real Estate Capital Partners have also dedicated funds toward the project; and the remainder will be raised publicly and privately in partnership with the Brooklyn Bridge Park Conservancy.

Eric Landau, Brooklyn Bridge Park President, said, “We are always striving to provide the best amenities and activities for park visitors. The temporary pop-up pool has been a much-loved summer attraction and now we are thrilled to announce plans to bring a permanent pool to Brooklyn Bridge Park.”

At the official announcement later this morning, Landau will be joined by Deputy Mayor and BBP Board Chair Alicia Glen, NYC Parks Commissioner Mitchell Silver, AND Brooklyn Borough President Eric Adams. We will update if any more information becomes available at the press conference.

Update: The pool will likely not open until 2020; community planning sessions will begin later this year.

This is not the first time Squibb Park has gotten a pool; in the 1940s (before it was named Squibb Park) there was a wading pool in the area.

Brooklyn Bridge Park Opens Pier 3

Brooklyn Bridge Park (BBP) today opened another five acres of parkland on Pier 3, the final pier to be converted to parkland. The opening brings the Park to 90% complete. The most prominent feature of Pier 3 will be its large central lawn protected from the wind and sun by groves of shrubs and trees. Along the north side of the Pier there is an exploratory labyrinth with interactive features. The outer section of the Pier hosts a grove with moveable furniture, including picnic tables and Adirondack chairs clustered to create a variety of seating areas. The surrounding hardscaped area provides space for small events and performances as well as unprogrammed play.

The labyrinth on Pier 3 has hedges of varying sizes to create an exploratory maze of picnic tables, mirrored games, and historic elements salvaged from the park like bollards, cleats, and excavated railroad tracks. Within the maze you will find a walk-in kaleidoscope, an echo game, dance chimes, parabolic reflectors, a conference tube, and interesting seating options, including Gunter Beltzig stone seating.

BBP President Eric Landau was joined by Deputy Mayor and BBP Board Chair Alicia Glen, NYC Parks Commissioner Mitchell Silver, Brooklyn Borough President Eric Adams, Rep. Nydia M. Velázquez, Assembly Member Jo Anne Simon, State Senator Brian Kavanagh, Council Member Stephen Levin, and Brooklyn Bridge Park Conservancy Executive Director Nancy Webster.

“The opening of Pier 3 is not only a milepost for Brooklyn Bridge Park – it’s a major event for our city. Now 90% complete, Brooklyn Bridge Park’s stunning views, cultural partnerships, and recreational amenities have transformed the industrial waterfront, and offer a global model for urban park development,” said Deputy Mayor Alicia Glen.

“Today is a great day for Brooklyn Bridge Park as we open Pier 3, the last pier to be transformed to parkland,” said Eric Landau, Brooklyn Bridge Park President. “We’re so excited to provide even more space for people to play and relax this summer. With Pier 3’s large central lawn and amazing labyrinth for children of all ages, Brooklyn Bridge Park just keeps getting better!”

There is now even more Brooklyn Bridge Park to enjoy!” said Commissioner Silver. “This beautiful destination park continues to grow and flourish, with exciting new interactive additions and more space to gather and relax. The countless visitors to Brooklyn Bridge Park this summer will surely love all that Pier 3 has to offer.”

“Pier 3 is a dynamic waterfront space that will offer endless opportunities for healthy recreation and relaxation to families from Brooklyn and beyond,” said Brooklyn Borough President Eric Adams. “Brooklyn Bridge Park is a gem that gleams brighter with each exciting acre it adds, building on our borough’s commitment to offer high-quality open space that brings people together from all walks of life.”

Today marks another important milestone in bringing Brooklyn Bridge Park closer to completion. This announcement also heralds yet more outdoor recreation options for Brooklyn residents and visitors to our borough. I applaud BBP on making this stride and thank all those who worked to open yet more space on Pier 3,” said Rep. Nydia M. Velázquez.

“I am thrilled to celebrate the opening of new parkland on Pier 3 in Brooklyn Bridge Park,” said Assemblymember Jo Anne Simon. “Visitors can now enjoy a beautiful lawn, explore the labyrinth, and enjoy the waterfront views around the outer section of the Pier. Thanks to the City of New York and the Brooklyn Bridge Park Corporation for continuing to improve and beautify our waterfront.”

“Pier 3 isn’t just five acres of additional parkland for Brooklynites and tourists, and it isn’t just space for events, performances, and play — it’s the project that brings Brooklyn Bridge Park to 90% completion. That is a remarkable achievement,” State Senator Brian Kavanagh said. “Every year, millions of New Yorkers and tourists take advantage of all that the park has to offer. Pier 3 will undoubtedly be another major draw that connects visitors with the East River Waterfront. I’d like to congratulate Brooklyn Bridge Park, the City of New York, my elected colleagues, the Brooklyn Bridge Park Conservancy, our partners in the community, and everyone who played a part in this great achievement — and I look forward to continuing to work with all stakeholders as the final portions of the park are completed.”

“It’s not a park until children, families, and New Yorkers from all over can come and make it their own — that long awaited day is today,” said Council Member Stephen Levin. “I’m excited to join the community in announcing the opening of Pier 3. While Brooklyn may be big, five new acres of open space is an even bigger deal, especially on the scenic waterfront. Just in time for summer, let’s join New Yorkers everywhere and make beautiful memories here at Brooklyn Bridge Park.”

“The center of Brooklyn Bridge Park needs an embracing green space, and with Pier 3 we finally have it. The bowl-like lawn provides a serene interior that I think will draw people in, acting as a complementary counterbalance to the dynamics of river and city. Logs of locust are here and there to sit on and more,” said Michael Van Valkenburgh, President and CEO of Michael Van Valkenburgh Associates, Inc. “My team and I have felt tremendously honored to lead the design of Brooklyn Bridge Park, and we are thrilled to see the final pier of the park finally open to the public.”

“What a great day as Brooklyn Bridge Park opens the last of its magnificent piers. With its inventive play labyrinth, expansive lawn, and flexible program space, Pier 3 promises to be yet another well loved destination in the park. The Brooklyn Bridge Park Conservancy can’t wait to join our neighbors from all over New York City — and the world — who will play, relax, and simply delight in this extraordinary new park space on the waterfront,” said Nancy Webster, Executive Director of Brooklyn Bridge Park Conservancy.

About Brooklyn Bridge Park

Brooklyn Bridge Park Corporation, known as Brooklyn Bridge Park (BBP), is the not-for-profit entity responsible for the planning, construction, maintenance and operation of Brooklyn Bridge Park, an 85-acre sustainable waterfront park spanning 1.3 miles along Brooklyn’s East River shoreline. As steward of the park, BBP has transformed this previously deteriorated stretch of waterfront into a world-class park where the public can gather, play, relax and enjoy sweeping views of New York Harbor. The self-sustaining park was designed by the award-winning firm of Michael Van Valkenburgh Associates, Inc. and features expansive lawns, rolling hills, waterfront promenades, innovative playgrounds, a greenway, sports facilities and the popular Jane’s Carousel. BBP serves thousands of people on any given seasonal day, who come to picnic, walk their dog, play soccer, jog, bike or roller skate. Brooklyn Bridge Park is a signature public investment for the 21st Century and will be an enduring legacy for the communities, elected officials and public servants who made it happen.

82 3 PLACE 2 Carroll Gardens. Available July 1st.

Gorgeous original details abound in this large 2BR. This is a rare 25 foot wide Carroll Gardens mansion on a lovely Place Street. Incredible moldings and 13 foot ceilings give this parlor floor great light and space. The large kitchen with cherry wood cabinets, granite counter top and stainless steel appliances makes cooking easy! Spacious center living room with French doors lead into a king size bedroom with custom shutters and two custom built closets. A spacious side room with oversized window completes this perfect Brooklyn home. Bathroom is brand new too. Heat and hot water are included and a window A/C is also provided. Zoned for PS 58.

Two blocks to the F/G train. Near Frankies 457, Buttermilk Channel, Prime Meats, Caputo’s and all the great shops of Carroll Gardens.

Price: $4200| Rental | Rooms: 2 | Bedrooms: 2 | Bathrooms: 2 | Approx Sq Ft: 1100

Available July 1st.

Call today or send me a message on my contact me page today.

Toronto home sales plunged 22% in May — and it shows the city’s housing bubble is getting serious

- Toronto home sales plunged 22% in May compared to a year ago, to 7,834 homes.

- Housing costs in the city had been soaring, with the Home Price Index up 32% in 2017 from a year earlier.

- The irony is that “housing affordability” is fundamentally impacted by prices and interest rates.

Average price of single-family house plunges 13%, or by C$160,000 from peak. Sales of homes priced over C$1.5 million collapse by 63%. Condos still hanging on.

Housing in the Greater Toronto Area is, let’s say, retrenching. Canada’s largest housing market has seen an enormous two-decade surge in prices that culminated in utter craziness in April 2017, when the Home Price Index had skyrocketed 32% from a year earlier. But now the hangover has set in and the bubble isn’t fun anymore.

Home sales plunged 22% in May compared to a year ago, to 7,834 homes, according to the Toronto Real Estate Board (TREB). It affected all types of homes, even the once red-hot condos:

- Detached houses -28.5%

- Semi-detached houses -29.4%

- Townhouses -13.4%

- Condos -15.5%.

It was particularly unpleasant at the higher end: Sales of homes costing C$1.5 million or more plummeted by 46% year-over-year to 508 homes in May 2018, according to TREB data. Compared to the April 2017 peak of 1,362 sales in that price range, sales in May collapsed by 63%.

But it’s not just at the high end. At the low end too. In May, sales of homes below C$500,000 – about 68% of them were condos – fell by 36% year-over-year to 5,253 homes.

The TREB publishes two types of prices – the average price and its proprietary MLS Home Price Index based on a “composite benchmark home.” Both fell in May compared to a year ago.

There are no perfect measures of home prices in a market. Each has its own drawbacks. Average home prices can be impacted by the mix and by a few large outliers – but over the longer term, it gives a good impression of the direction. The chart below shows the percentage change in average home prices in the GTA compared to a year earlier:

Wolf Street

Wolf StreetThe TREB’s proprietary Home Price Index is based on a “composite benchmark home” and strips out the impact of changes in mix and large outliers that may afflict the average price. And the HPI Composite Benchmark fell by 5.4% year-over-year.

All home types except condos experienced year-over-year price declines in the HPI, with detached homes also getting hit the hardest:

- Detached houses: -10.2%

- Semi-detached houses: -8.5%

- Townhouses: -4.3%

- Condos: +8.3%

The inventory of homes for sale rose by 13.2% in May compared to a year ago, to 20,919 active listings. At the rate of sales in May, this worked out to a supply of 2.7 months, up from 2.3 months in April and from 2.1 months in March. The average days-on-the-market before the home was sold or before the listing was pulled without sale jumped to 20 days in May from 11 days a year ago.

Among 9 listed issues (health care, government spending/balancing budget, taxes, housing affordability, energy costs, economy, transportation/traffic, environment/climate change, enhancing social programs), 25% of GTA residents rank housing affordability in their top two most-important issues for the Ontario election campaign;

69% agree (35% strongly/34% somewhat) that a party’s platform on housing affordability will influence who they vote for on election day.

The irony is that “housing affordability” is fundamentally impacted by prices and interest rates. Interest rates have come up a tiny bit from historic lows and remain historically low. But prices have surged for two decades. What will make the Toronto housing market more affordable for many people would be a substantial decline in prices. So if the TREB wants to enhance housing affordability for folks in Toronto, it should advocate for policies that will bring down home prices – of the kind that the government has been implementing – and not advocate against them. But advocating against them is precisely what the TREB, as real estate lobbying group, has been doing with a passion for a year.

Chicago’s rents are in free-fall, Washington DC’s rent suddenly plunge, New York’s rents fall to third place. But rents soar in Southern California and other parts. Bay Area and Seattle are “mixed.”

New startup wants to help you make a cash offer on a house

With bidding wars on homes flaring up all over the country, cash offers trump all

as reported by Jeff Andrews

Anyone who has sold a home knows there’s a fair amount of uncertainty in the transaction between receiving an offer and actually closing the sale, which can take as long as 90 days. A buyer’s mortgage application could unexpectedly be denied, or the buyer could walk away from the deal at the last minute, forcing the seller to start the whole process over again by putting the home back on the market.

It’s no wonder then that when armed with an all-cash offer on a home, the offer is 97 percent more likely to be accepted, according to Redfin. Cash offers remove much of the time and uncertainty associated with obtaining a mortgage for the transaction, allowing sellers to move in short order and on coordinated timelines.

With one economist calling this spring “the most competitive housing market in recorded history,” all-cash offers have become a trump card for the wealthy in home-bidding wars that have erupted all over the country. But Ribbon, a startup that launched last week, wants to give the cash-offer advantage to everyone.

Backed by venture capital firms NFX, Bain Capital, Greylock, and NYCA, the startup launched in Charlotte, North Carolina, and represents both home buyers and sellers, and, in short, provides a guaranteed offer to facilitate all-cash home transactions, in exchange for a 1.95 percent fee.

“We’re taking that single value proposition that a lot of these institutions and iBuyers have, which is access to capital, and we’re democratizing that capital for the benefit of consumers instead of using it for corporate profits,” said Ribbon CEO Shaival Shah. “Cash discounts that consumers earn from our program flow directly back to the consumer. Based on our early deal volume, customers are seeing an average of 5 percent savings to the purchase price by using Ribbon.”

Surging Mortgage Rates Set Off Scramble To Buy Homes

U.S. homebuyers, already contending with escalating prices, now are getting hit with the most-expensive mortgage rates in seven years. Funny thing: It’s only making them move faster.

The average rate for a 30-year fixed mortgage jumped to 4.61 percent, up from 4.55 percent last week and the highest since May 2011, Freddie Mac said in a statement Thursday. And homes that sold last month went into contract after a median of 36 days on the market — a record speed in data going back to 2010, according to a new report by brokerage Redfin Corp.

“This is what happens when the economy is strong,” Sam Khater, Freddie Mac’s chief economist, said in a phone interview. “All the higher-rate environment does is it either causes them to try and rush or look at different properties that are more affordable.”

The solid data that’s boosting confidence in the economy has sent benchmark Treasury yields soaring, and homebuyers — encouraged by income growth and low unemployment — are rushing to lock in loans before borrowing costs climb even higher. With a short supply of listings, the increased competition is only making their purchases harder to afford.

Home prices jumped 7.6 percent in April from a year earlier to a median of $302,200, and sellers got a record 98.8 percent of what they asked on average, Redfin said Thursday.

Bidding wars aren’t uncommon. Mary Sommerfeld, a Minneapolis-area Realtor, said a family she works with offered $33,000 more than the $430,000 list price for a home in St. Paul. The listing agent gave her the bad news: There were nine offers and the family’s was second from the bottom.

For Sommerfeld’s clients, the lack of inventory is a bigger problem than rising mortgage rates. If anything, they want to close quickly before they get priced out of the market — and have to pay more interest.

“I don’t think it’s hurting the buyer demand at all,” she said. “My buyers say they better get busy and buy before the interest rates go up any further.”

With this week’s jump, the monthly payment on a $300,000, 30-year loan has climbed to $1,540, up from $1,424 in the beginning of the year, when the average rate was 3.95 percent.

Kristin Wilson, a loan officer with Envoy Mortgage in Edina, Minnesota, tells customers to keep things in perspective. When she bought a house in the early 1980s, the interest on her adjustable-rate mortgage was 12 percent, she said.