The New York City housing market could not look more different today than it did at the beginning of the 2010s.

The financial crisis in 2008 didn’t hit New York housing as hard as it did in other cities, and when it did, it hit the outer boroughs first. Manhattan, propped up by what were still high levels of compensation in the financial sector, was the last of the boroughs to see home prices drop; but when they did fall, they fell hard.

This meant that in 2010, the city’s housing market was still in the recovery stage from the crisis. Housing inventory for sale was still piled up on the market as mortgage credit availability vanished and unemployment spiked. This dropped home values down to what today would be considered absolute bargain basement prices.

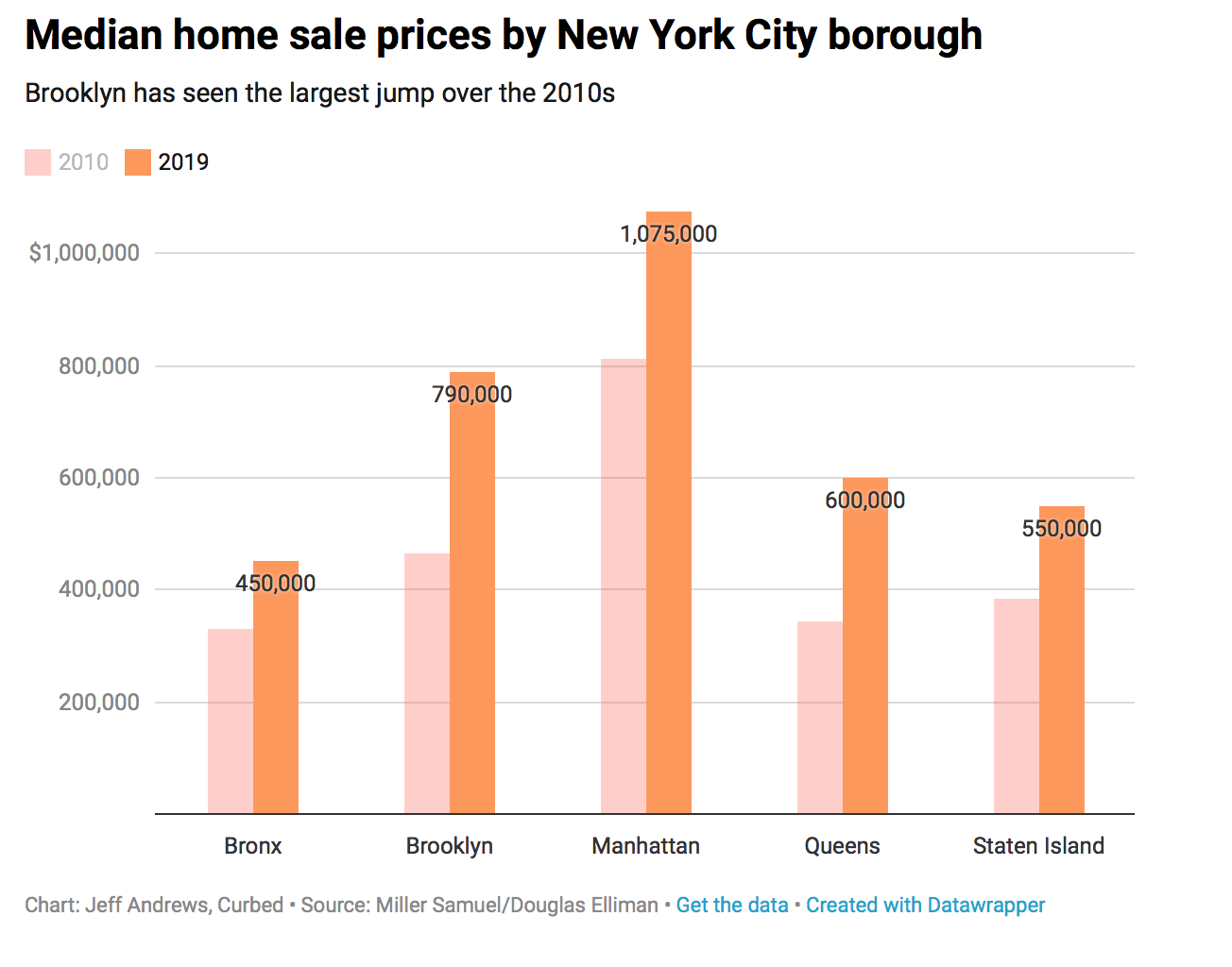

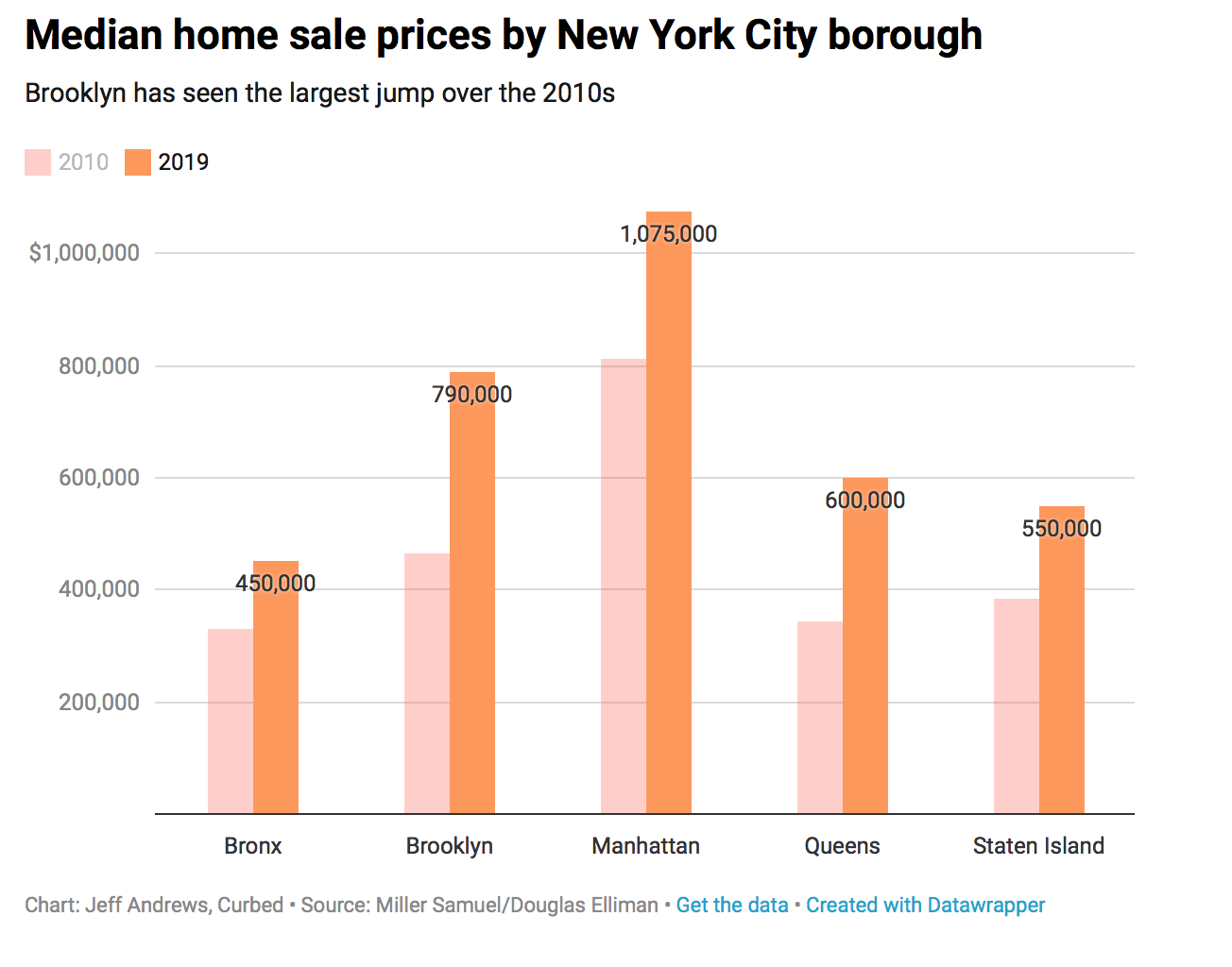

The median home sale price for all of New York City in the first quarter of 2010 was $383,699, according to data provided to Curbed by Miller Samuel/Douglas Elliman. Prices started rising in earnest around 2013, boosted by an onslaught of luxury housing hitting the market; by the third quarter of 2019, that number had almost doubled to $675,000.

But digging deeper into the data shows how the housing market in New York City has changed over the last 10 years. Let’s take a look.

Manhattan’s luxury market fizzles

Manhattan has always been one of the most expensive housing markets in the world, but the 2010s took that to another level, as ultra-luxury housing developments—including the entirety of what is now known as Billionaire’s Row—provided new additions to both the skyline and the real estate market.

Developers have a challenging task when building in Manhattan: Lots are scarce, the ones that are available are expensive, and the cost of building materials has risen dramatically over the decade. All of this pushes developers into building luxury housing for the luxury market. But according to Jonathan Miller, president and CEO of the appraisal firm Miller Samuel, advances in engineering contributed to the jump in luxury developments in the 2010s.

“Just in the last decade now you could build a much taller building on a much smaller footprint and the math begin to work,” he said. “You see this influx of projects that were selling views.”

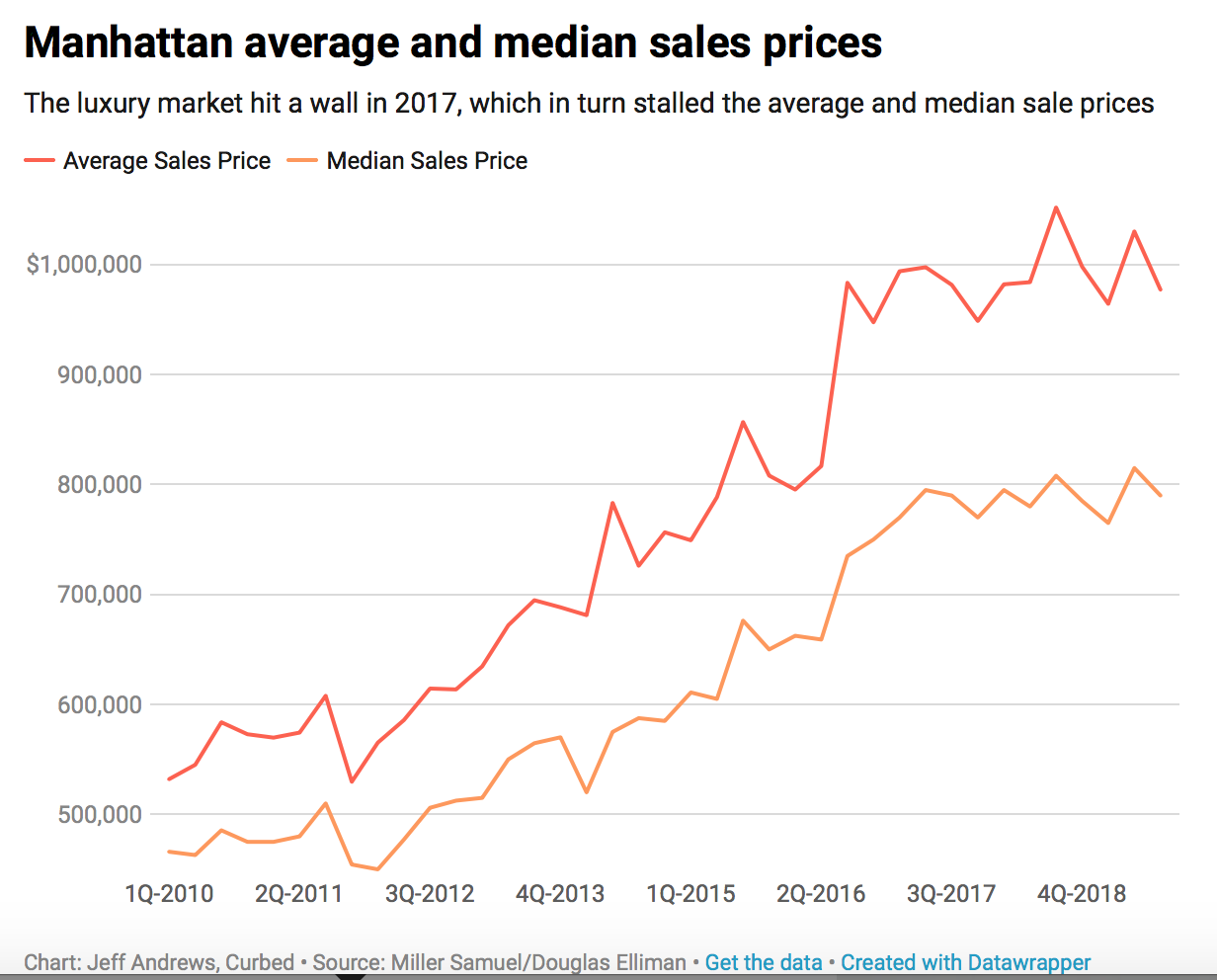

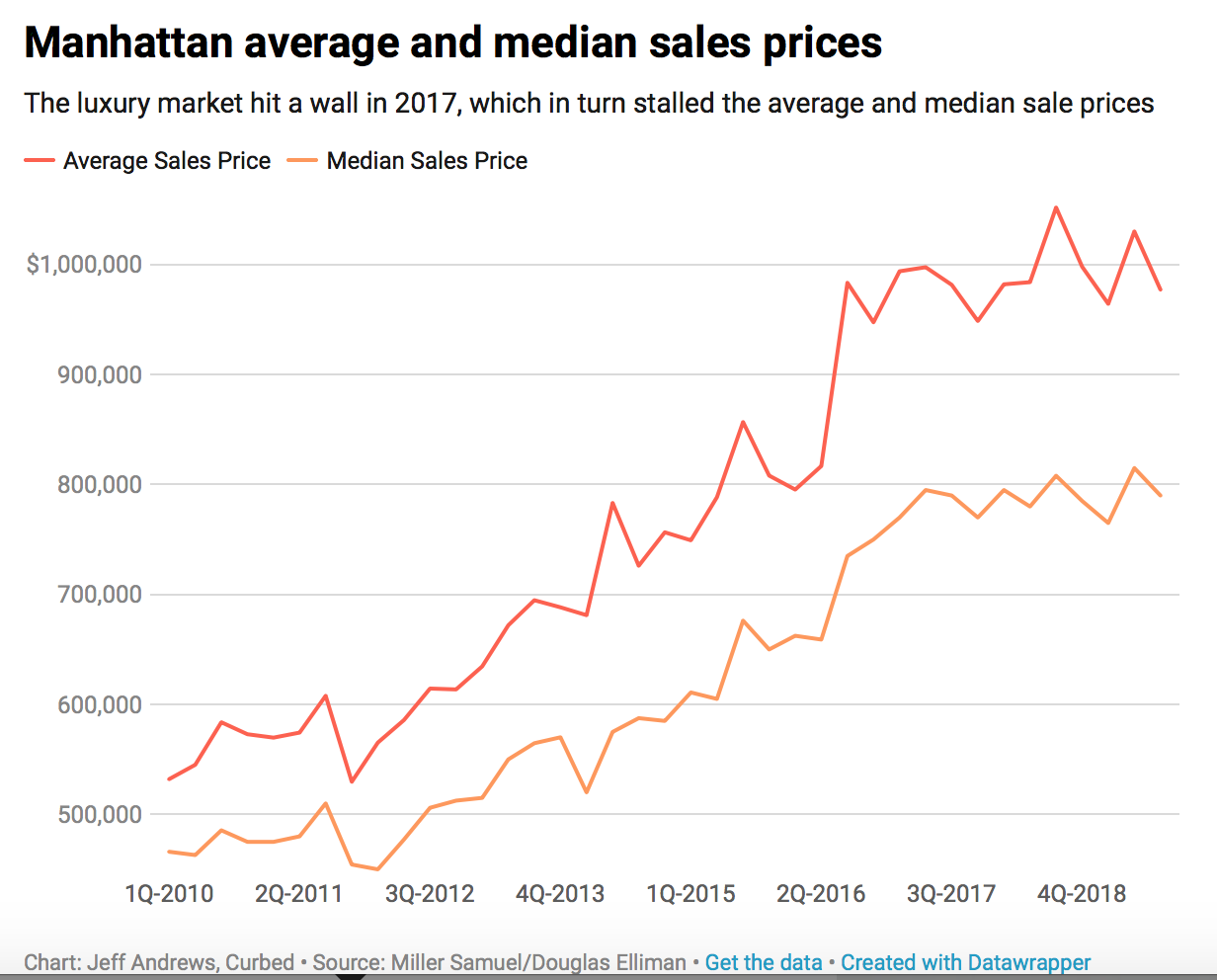

However, as the housing recovery progressed and more luxury developments came online, the market became oversaturated at the high end. This is reflected in the data for median and average home prices. (The median price is in the middle of all the home sale prices during a given period; the average price takes all of the closed sales, adds them up, and and divides by the number of prices.)

In the fourth quarter of 2016, the average sale price of a Manhattan home jumped by more than $100,000, but has since stalled at around $1 million, while the median stalled at around $800,000.

Brooklyn becomes a global destination

At the turn of the decade, people outside of New York might have known Brooklyn as a former manufacturing hub, the home of a robust indie rock scene, or possibly as a source of hotels cheaper than those in Manhattan. But today, Brooklyn is a globally recognized brand with its own professional basketball and hockey teams, a thriving restaurant scene, and—as a result of systematic gentrification—soaring home prices that in some neighborhoods rival Manhattan’s.

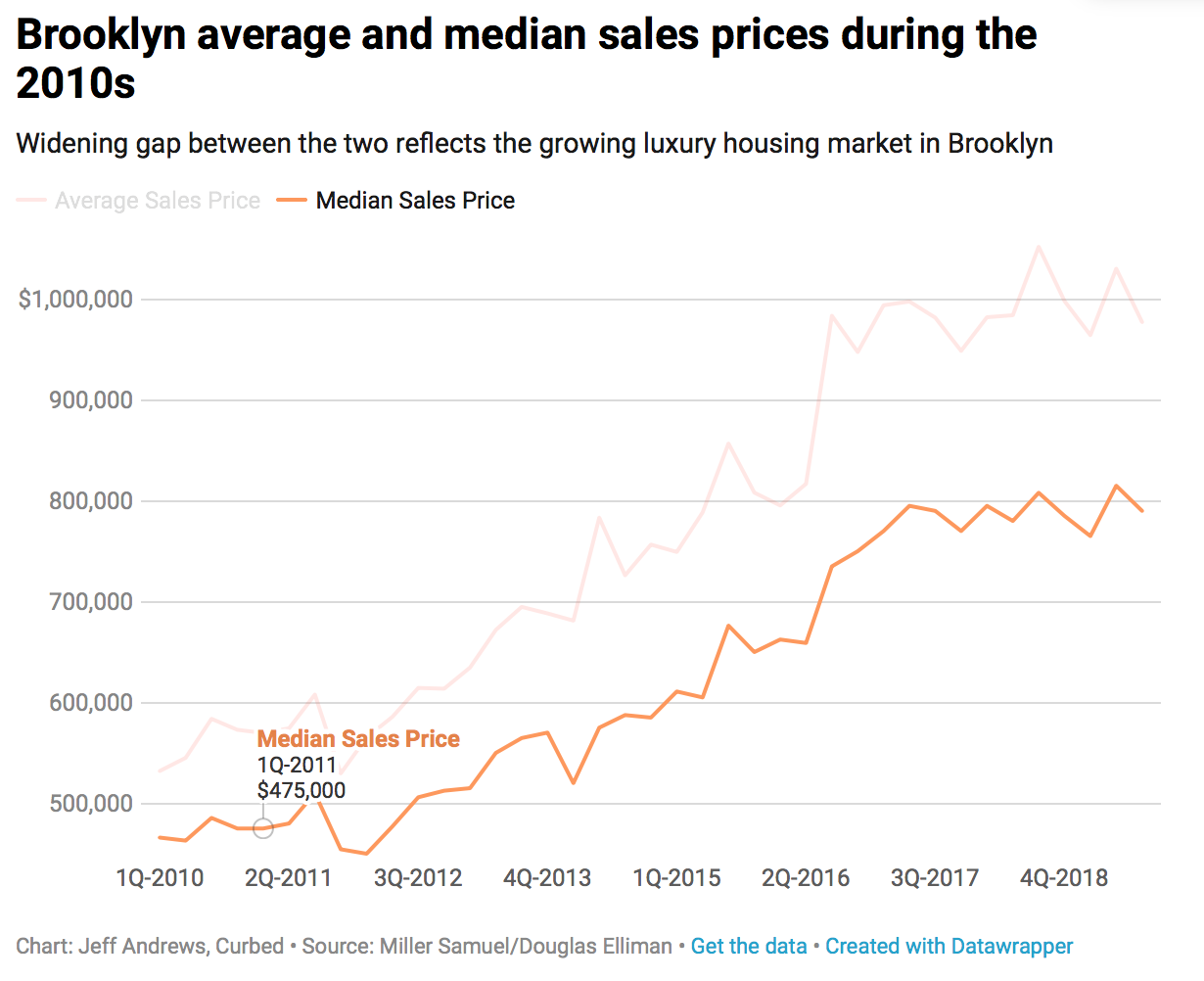

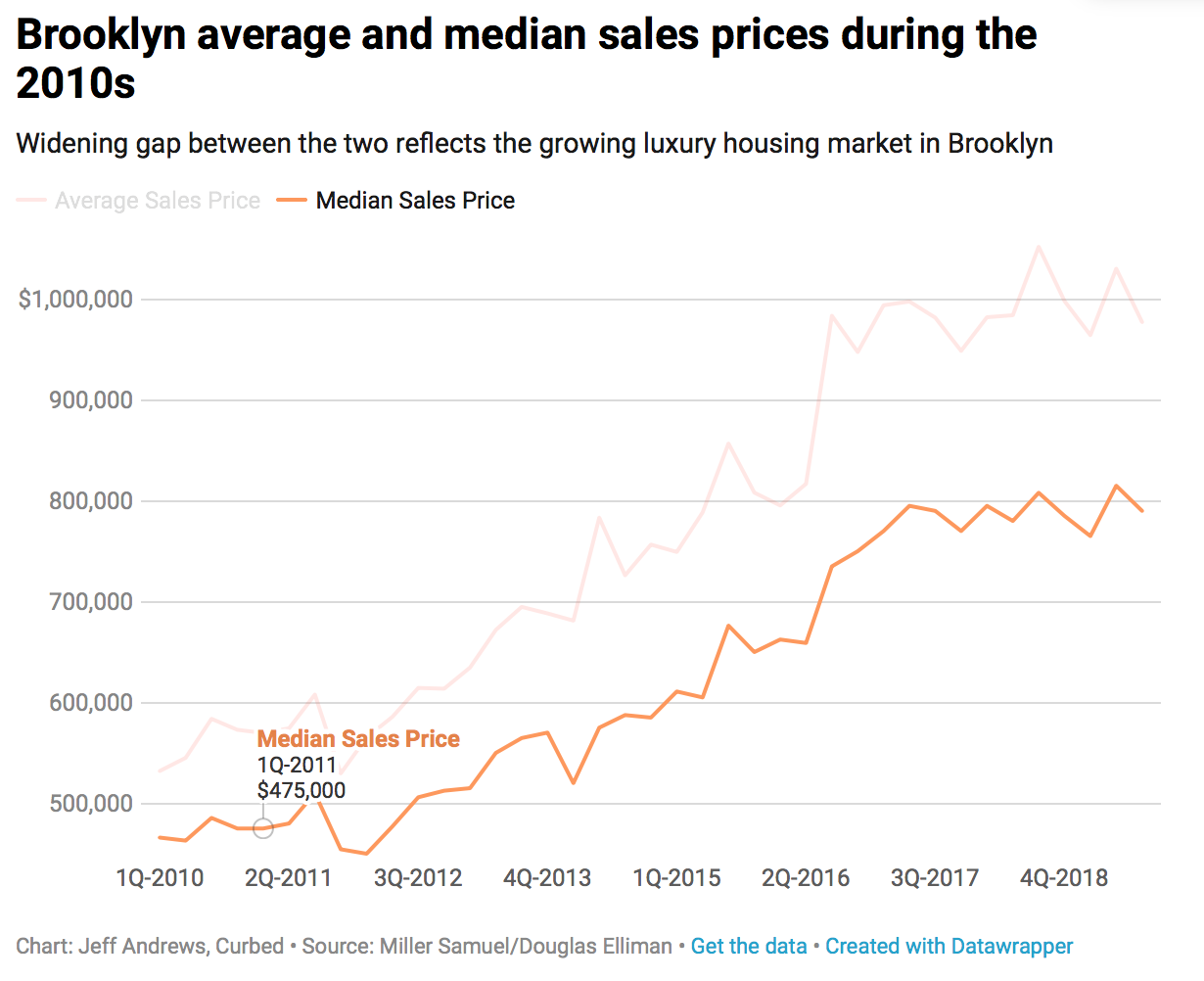

The blossoming luxury market in Brooklyn is one of the biggest developments in New York City housing in the 2010s. Neighborhoods like DUMBO and Williamsburg transformed from quirky hipster locales into havens accessible only to the very wealthy. Luxury housing developments like Pierhouse in Brooklyn Bridge Park and Oosten in Williamsburg sprang up over the last 10 years, transforming the Brooklyn side of the East River.

This development is reflected in the widening gap between the borough’s median home sale price and the average home sale price. At the beginning of 2010, the gap between the median and average home sale prices for Brooklyn was just $66,061, according to data provided by Miller Samuel and Douglas Elliman. By the third quarter of this year, that number ballooned to $187,259, reflecting the growing luxury market in Brooklyn.

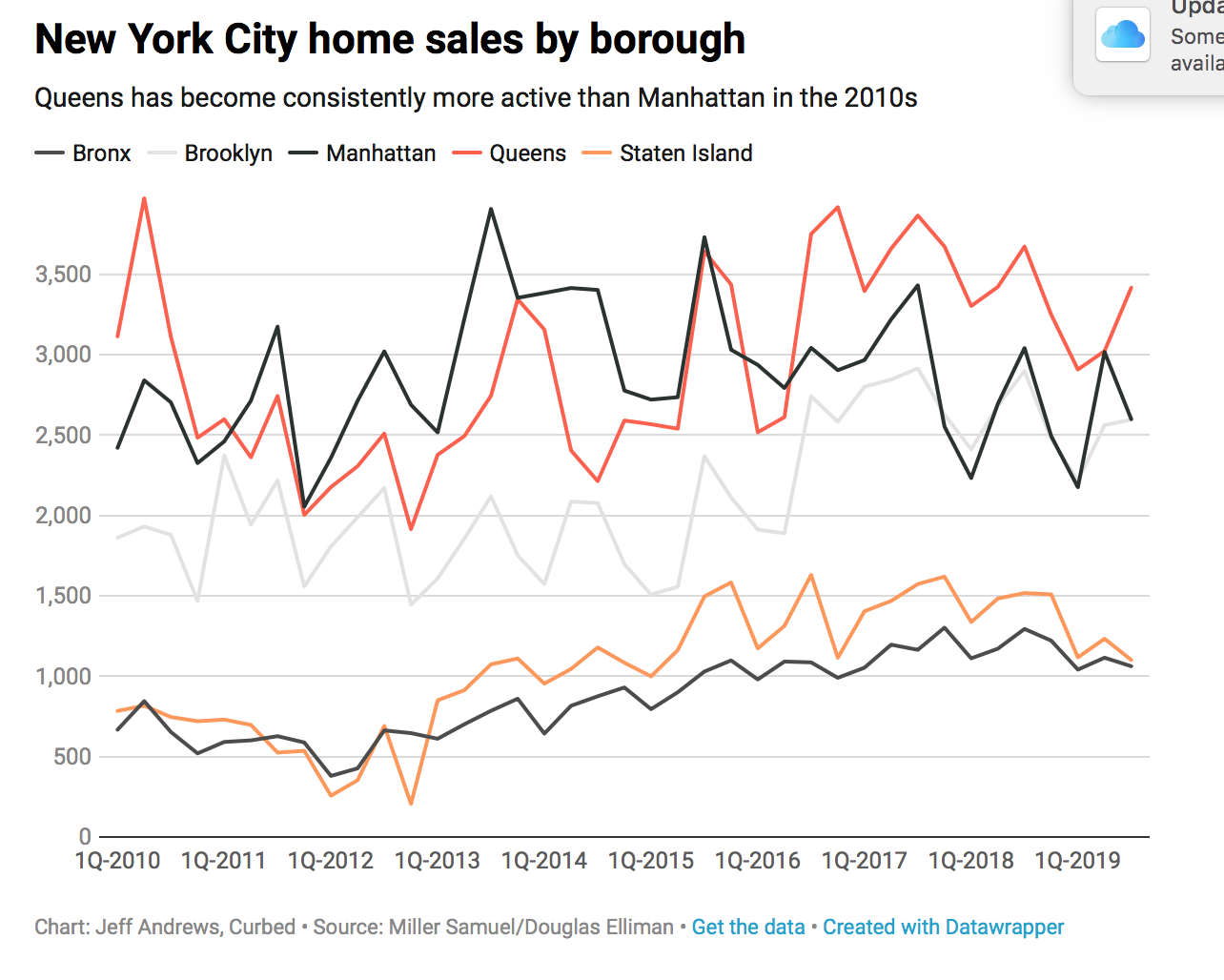

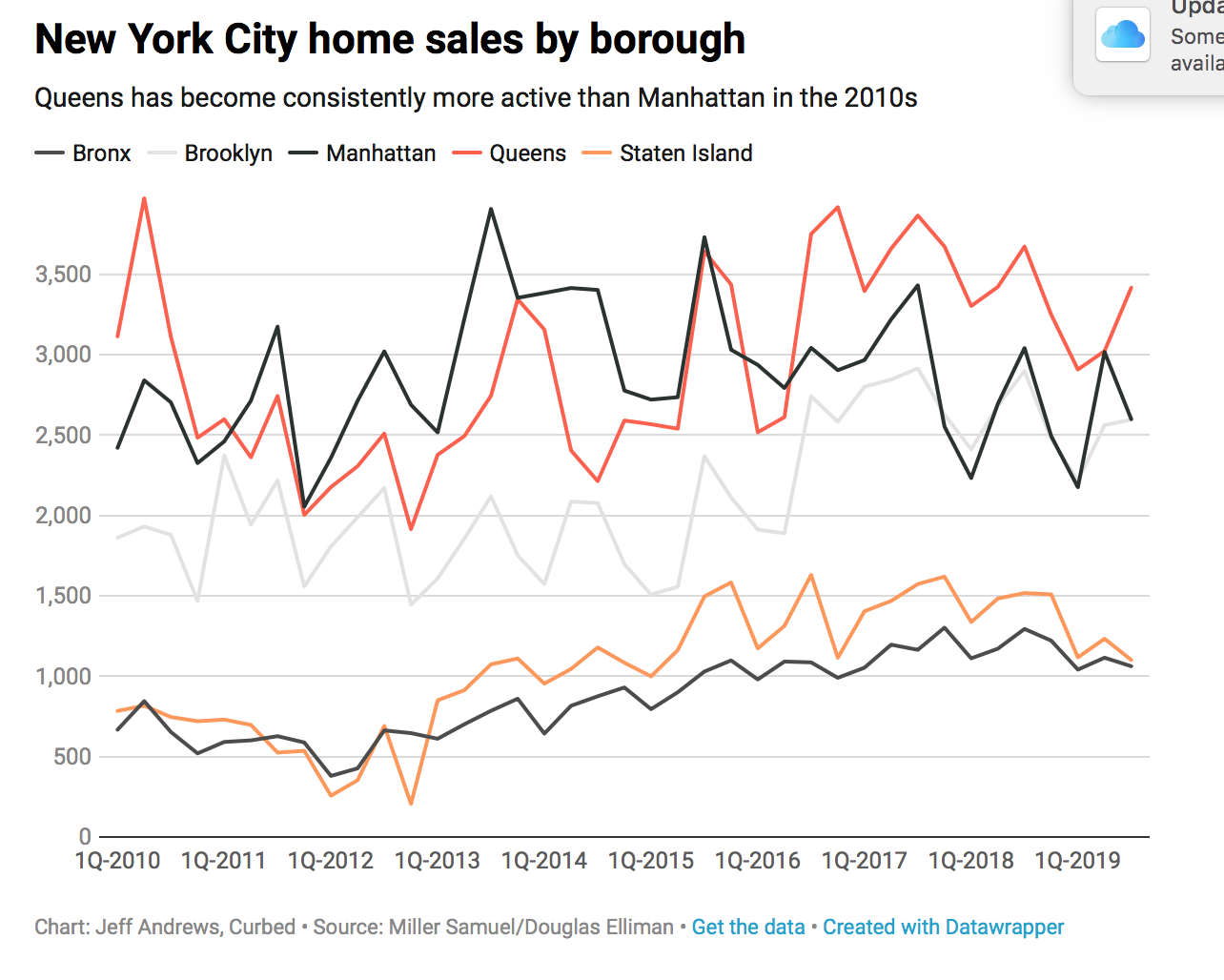

Activity in Queens soars as people are priced out of Brooklyn

While Brooklyn was long seen as the cheaper alternative to Manhattan, Queens became the cheaper alternative to Brooklyn in the 2010s as Brooklyn home prices got increasingly out of reach.

This was particularly prevalent along the border between the two boroughs. Long Island City, Sunnyside, and Woodside saw increases in the number of home sales as potential buyers were pushed out of Brooklyn. And the northwestern Queens neighborhoods—Long Island City and Astoria—saw price spikes as buyers eyed a commute to Manhattan that in some cases is more convenient than Brooklyn.

“[Northwest Queens] has more of a relationship to Manhattan than it does to Queens in terms of pricing,” says Miller. “I see their expansion or development consistent with what we’ve seen in Brooklyn. They’re being reinvented as residential areas. It’s an easier commute than Brooklyn if you work in Manhattan.”

After the market bottomed out following the financial crisis, Queens settled into a position where it had the second most home sales of the five boroughs. But beginning in late 2016 it jumped ahead of Manhattan and has had the most home sales of any borough in every quarter since.

The outlook for the 2020s

While no one expects a crash of the severity and scale of 2008—and the underlying conditions in the mortgage market that caused the 2008 crash simply do not exist in the current housing market—recession fears have permeated the industry, leading some to believe that a pullback or correction is due.

Housing affordability in New York City is already pushed to its limit, and that’s reflected in the dwindling number of sales, particularly at the high end of the market. With mortgage rates already unusually low, the real estate industry won’t be able to rely on an interest rate drop to prop up the market; there isn’t much room for them to go lower.

Miller says he expects additional weakness in the market in 2020, thanks to factors like the forthcoming presidential election; sales activity will likely drop in the run-up as people wait to see what economic policies are pursued by the winning candidates.

If a recession does hit, it could have a modest impact on prices, but because of the wealth in New York City, the housing market is more durable than some others. And while the recession after 2008 was directly caused by problems in the housing market, most recessions haven’t had a big impact on home prices, so don’t hold your breath that bargains could be on the way.

Fabulous Top Floor

Fabulous Top Floor