Life Changes and Real Estate: Trading Up, Moving On

Life Changes and Real Estate: Trading Up, Moving On

As mentioned last week, BHS agents Dena Driver, Jennifer Burns and Catherine Witherwax put together an awesome panel discussion for people looking to trade up or downsize. Check out the recap here!

Life Changes and Real Estate: Trading Up, Moving On

Life Changes and Real Estate: Trading Up, Moving On

As mentioned last week, BHS agents Dena Driver, Jennifer Burns and Catherine Witherwax put together an awesome panel discussion for people looking to trade up or downsize. Check out the recap here!

The 2019 housing market has been one of low rates, high demand and limited supply—particularly on the lower-priced end of the market.

Will 2020 be more of the same? According to experts, yes and no.

We spoke to six mortgage, real estate, and housing professionals. Here’s what they say is in store for the year to come:

Mortgage rates will stay low—or maybe go lower.

Mortgage rates currently sit at 3.75%, according to Freddie Mac’s most recent numbers—nearly a 1% difference from the monthly average a year ago. The drop in rates caused a surge in refinancing over the last few months, and purchase activity ticked up as well.

According to Odeta Kushi, deputy chief economist at title insurance and settlement services provider First American, there’s “emerging consensus” that rates will remain low next year—likely somewhere between 3.7% and 3.9%, she says.

Forecasts from Freddie Mac and the Mortgage Bankers Association back this up, both predicting 2020 rates within this range. Fannie Mae actually predicts rates will clock in even lower, vacillating between 3.5% and 3.6% throughout the year.

Prices will keep on rising.

Home prices will continue their climb upward, according to experts, largely thanks to tight inventory and high demand.

According to the latest home price forecast from property data firm CoreLogic, home prices should tick up by 5.6% by next September—up from the just 3.5% jump we saw this year.

As Daryl Fairweather, chief economist for real estate brokerage Redfin, explains, “Right now we aren’t seeing a ton of new listings. Without more listings coming on the market, there will be more competition starting off in early 2020 and that will lead to more price pressure.”

The problem will be worse on the lower end of the price spectrum. According to Ralph DeFranco, chief economist for mortgage insurer Arch MI, entry-level home prices will rise higher than incomes next year—and disappointing construction numbers will only compound the issue.

“Low interest rates and a shortage of starter homes will continue to push up prices,” DeFranco said. “This is especially the case for lower price points, since builders have tended to focus on more expensive, higher-profit houses and less on replenishing low inventories of entry-level homes.”

It seems the price growth may continue beyond 2020, too. Data from Arch MI shows the chance of home price declines at a mere 11% for the next two years. There are currently no states or metro markets projected to see prices declines in that period.

Inventory will be tight.

Housing inventory is going to remain limited for much of 2020, experts say. And interest rates and record-high homeownership tenures are a big part of the problem.

According to recent data from Redfin, the average homeowner is staying in their home 13 years—up from just eight years in 2010. In some cities, homeownership tenures are as high as 23 years.

As Kushi explains, “You can’t buy what’s not for sale.”

“While historically low rates increase buying power and make it more likely for potential buyers to attain their homeownership dream, they also increase the risk of a long-run housing supply shortage, which we predict will continue through 2020 and possibly intensify,” Kushi says. “As first-time buyers lock-in these historically amazing rates and existing owners refinance—in droves in recent months, everyone will stay put and not sell. Where’s the incentive?”

There’s a chance that increasing construction may offer some relief in the inventory department. Last month’s residential construction report from the Census Bureau saw building permits and housing starts both increase over the year. At the same time. builder confidence was at a 20-month high, according to the National Association of Home Builders.

Still, it may not be enough to meet the needs of today’s buyers, Kushi says.

“As for building new homes, builders have a reason to be cautiously optimistic, given pent up demand stemming from a strong economy, lower mortgage rates and continued wage growth,” she says. “However, building pace still lags behind historical standards, and it will likely take months before we can begin building at a pace that will support the demand.”

Millennials will keep up their homebuying streak, while Boomers hold up inventory.

Data from Realtor.com shows Millennials made up a whopping 46% of all mortgage originations in September—up from 43% one year prior. Meanwhile, shares of Baby Boomer and Gen X mortgage activity declined.

It’s no wonder, either. Millennials rank homeownership as one of their top goals in life—higher than even marrying or having kids—and with interest rates low and incomes up, it’s the right time to buy a home for many.

Unfortunately, they face an uphill battle. As Kushi explains, “Looking ahead, Millennials may be entering a tougher housing market in 2020. A limited supply environment, combined with growing demand and increased competition for homes, is accelerating home price growth once again.”

The Baby Boomer generation is part of the challenge for this younger cohort, as many are choosing to age in place—keeping more homes off the market than ever before.

In fact, a recent study from Freddie Mac shows that if today’s older adults—those born between 1931 and 1959—behaved like earlier generations, then an additional 1.6 million homes would have hit the market by the end of the last year.

As Kushi puts it, “The fate of Millennial homebuying to close out 2019 and into 2020 will depend on two factors: if there is anything for them to buy, and whether rising purchasing power stemming from increasing income and historically low mortgage rates can continue to outpace house price appreciation.”

The suburbs will be a big draw thanks to Millennial demand.

As home prices skyrocket, cash-strapped Millennials are looking toward more affordable places to put down roots—namely smaller, suburban towns on the outskirts of major metros.

The trend has led to an uptick in “Hipsturbia” communities—live-work-play neighborhoods that blend the safety and affordability of the suburbs with the transit, walkability and 24-hour amenities of big cities.

Melissa Gomez, an agent with ERA Top Service Realty in New York, has seen the trend in action.

“Being based in the boroughs of NYC, I see Hipsturbia happening every day,” she said. “As cities like New York become increasingly expensive, younger people and families are looking for more bang for their buck with real estate, schooling and everything in between. And slowly but surely, it is breathing new life into small towns outside of major urban hubs.”

The Urban Land Institute recently named Histurbia as one of its top real estate trends to watch in 2020.

As the report explains, “If the live-work-play formula could revive inner cities a quarter-century ago, there is no reason to think that it will not work in suburbs with the right bones and the will to succeed.”

The industry will continue to digitize.

The mortgage and real estate spheres have been moving away from their manual, paper-laden processes in recent years, and 2020 will only see that trend expand further—especially as more tech-savvy Millennials enter the market.

As Hundtofte explains, “In 2020, we’ll continue to see Millennials growing their share of the mortgage market, which in turn, will serve as a catalyst to lenders to continue to rapidly innovate their technology offerings to meet the expectations of an audience more accustomed to an Amazon, Venmo-like experience.”

Though plenty of tech offerings already exist—from e-signing and e-notary software to fully-digital mortgage applications, automated income verification and more—Hundtofte says we’ll probably see these solutions start teaming up in the new year.

“Rather than compete with each other, we’ll see companies combining technologies across the board, from startups partnering with startups to startups partnering with legacy institutions,” he says.

Aaron Block, the co-founder of MetaProp—a venture capital fund focusing solely on real estate technology—says to keep an eye on the Airbnb and WeWork brands specifically in this regard.

On WeWork’s recent IPO blunder, Block says, “One major positive outcome of this year’s ‘DiePO’ is the plethora of ‘proptech’ innovation talent hitting the street. Some exciting new companies are being formed as we speak.”

As reported by Forbes, written by Aly J. Yale

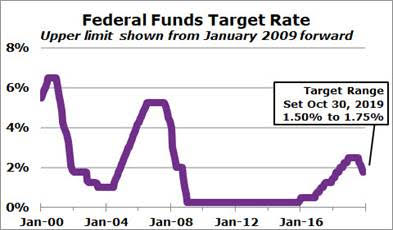

The Federal Reserve lowered its target range for the federal funds rate on Wednesday, October 30, its third rate cut in the last three months. The move was highly anticipated by market analysts.

The Federal Reserve lowered its target range for the federal funds rate on Wednesday, October 30, its third rate cut in the last three months. The move was highly anticipated by market analysts.

The target range, the Fed’s primary policy lever for short-term interest rates, was cut by 25 basis points and is now 1.50% to 1.75%.1

The previous two rate cuts, which took effect on August 1 and September 19, were also 25-basis point reductions.

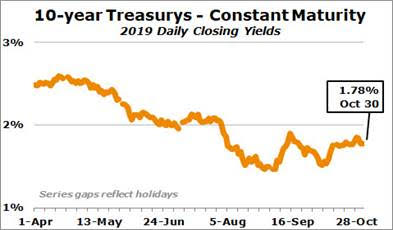

Mortgage rates react to more economic and financial factors than  just the Fed’s policy on the short-term side of the financial markets. Consequently, the Fed’s action doesn’t necessarily imply any particular direction for mortgage rates.

just the Fed’s policy on the short-term side of the financial markets. Consequently, the Fed’s action doesn’t necessarily imply any particular direction for mortgage rates.

One important guidepost for mortgage pricing is the yield on the 10-year Treasury note, which closed at 1.78% on Wednesday, October 30.2 The yield has averaged 1.81% over the past five trading days. In September, the yield averaged 1.70%.

The gap between the yields on the 2-year and 10-year Treasury securities has increased in October. With one trading day to go in the month, October has seen the 2-year Treasury average 1.55% while the 10-year averaged 1.71%. The resulting yield curve gap of 16 basis points is up from September’s 5 basis points. In October 2018, the yield curve gap was 29 basis points. Financial markets consider a negative yield curve gap an indicator of an oncoming recession.

Reported by Brian Scott Cohen Wells Fargo Home Mortgage, October 31, 2019

Your house is likely in one of two camps right now: sold or trying to get sold. And every spring, like clockwork, you can be sure that Uncle Sam comes knocking, magnifying glass in hand, to determine whether he can share your gains. As a home seller (and thereby an investor), there are ways you can minimize this capital gains tax — a type of tax on “profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.”

In this case, your house is considered a capital asset and, depending on how much you sell it for and how long you’ve owned and lived in it, there are 5 tax deductions that could apply to you in order to lower your capital gains tax obligation.

When you sell a house, there’s a fine line between what you can deduct and what you cannot. There’s also a ton of confusing information on the internet and, unless you’re a seasoned tax professional, the mystifying tax lingo doesn’t make it any easier to understand.

Lucky for you, we’re here to help you separate fact from fiction, navigate the pesky tax slog and filter the deductions that best apply to your situation come April.

Well, it comes down to a few key factors:

Are you single or married?

According to Nolo, most people “who sell their personal residences qualify for ahome sale tax exclusion” — which means you won’t need to pay taxes on gains of $250,000 for single homeowners and $500,000 for married homeowners filing jointly. However, if your profit exceeds these amounts, you’ll need to pay taxes on the excess.

Is this house your primary residence? How long have you owned and lived in it?

TaxAct explains that to exclude the above gains ($250K and $500K, respectively) from your tax obligation, you need to meet the following 3 qualifications:

Tip: Did you sell your house for under $250K, if you’re single, or under $500K, if you’re married, — and did you live in it for at least two of the five years before you sold it? If both are true, the IRS doesn’t want to hear about it, according toU.S. Code Section 121.

Let’s say you haven’t had the opportunity to own or live in the house for two of the last five years before the date of sale. According to NerdWallet, you might still be able to take advantage of a reduced or partial exclusion due to special circumstances “such as a change in employment, even if you haven’t met the ownership/residency requirements.”

With that in mind, here are the top deductions — caveats and requirements in tow — that sellers can use to minimize their capital gains tax obligation when tax season rolls around.

Now, let’s go through the various types of real estate tax deductions and debunk some of the most common myths:

Myth 1: “I can deduct the costs of maintenance, repairs, and decorating related to preparing my home for sale.”

Fact: Run-of-the-mill home repairs necessary to maintain your property’s condition or get it ready for sale are not tax deductible under current tax code Publication 523. Confusion arises over online reports that may erroneously refer to dated federal IRS code that allowed home sellers to deduct “fixing-up” expenses, such as “the costs of painting the home, planting flowers, and replacing broken windows” completed in the 90 days prior to closing. That tax break no longer exists. Under today’s tax rules, however, you are allowed to increase your cost basis by tacking on additional costs spent on capital improvements for the home.

Generally speaking, the government wants a piece of any “capital gains” (aka profit) you make from selling off assets like stocks, bonds or—you guessed it—property.

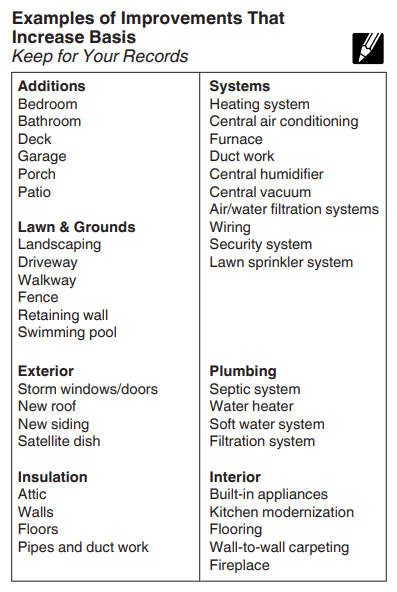

But you can mitigate your tax liability by reducing the amount of home sale profit the IRS considers taxable. If your home sale profits exceed the capital gains exemption threshold ($250,000 for single filers, and $500,000 for married filers) you can add capital improvements to your cost basis. The IRS defines a capital improvement as any home improvement that “adds market value to the home, prolongs its useful life or adapts it to new uses.”

It can sometimes be difficult to determine if the improvement you made before closing was a capital improvement or just a repair.

Thankfully, page 9 of IRS Publication 523 provides specific examples of improvements that actually add to the value of the house and, thus, can be deducted from your tax obligation.

Review the list and consider if any of them apply to you.

Myth: “I can’t deduct my real estate agent’s commission fees.”

Fact: Yet another reason why it’s worth it to hire a top real estate agent!

Not only can they guide you through the daunting process, help sell your house faster and for more money and provide you with advice you can’t get anywhere else, — because your best interest is their best interest — but you can deduct their fees from your capital gains tax obligation, too.

According to Nolo, you can also deduct the following costs when selling your house:

Have you sold your house?

Collect all receipts and invoices that pertain to your individual selling costs — including services you’ve hired for — when you closed on the house, and then file them under separate sections so you’re organized come tax season.

Are you currently selling your house?

While you may not necessarily incur costs from all of the above as you sell your home — with or without the help of a top agent — keep tabs on your spending so you’re not scrambling for numbers in the spring.

Tip: According to the IRS Publication 523, if you, as the seller, paid for “transfer taxes, stamp taxes, or other taxes, fees, and charges when you sold your home” you can treat these as selling expenses and deduct them from your home sale profit.

Myth: “I can’t deduct moving expenses.”

Fact: Turns out you can — but only if you’re relocating for work.

There’s another stipulation: Home Guides by SFGate explains that to “qualify to write off your moving expenses, your new home must be at least 50 miles closer to your new job than your old home was.”

If that sounds like you, you can deduct the mileage you drive (if applicable), moving company expenses, moving supplies and other travel expenses.

Have you already sold your house?

Whether you’re transitioning out of your old house or already settled in your new one, try to make a list of the moving expenses applicable to you — before you start at that new job!

Are you currently selling your house?

If you’re selling your house for work-related reasons — and that’s a big if — it’s never too early to consider how you’ll move yourself, your family and your belongings.

If you answer yes to any of those questions, collect all the receipts.

Tip: Keep the offer letter from your new job on hand when tax season comes around, too. Just in case.

Myth: “I can deduct all the taxes I paid to local and state

governments, including income, property and sales taxes.”

Fact: This used to be true — before Congress passed, and President Donald Trump signed into law, the Republican tax bill in December of 2017.

According to Business Insider, there is now a limit to how much you can deduct: “…the new law caps the deduction at $10,000, either for property taxes, state and local income taxes or sales tax” — and you can only deduct property taxes if they were assessed by your local government and paid the previous year.

As for when you can officially pass the property tax bill baton? The date the buyer purchases the property — which, TurboTax explains, “is typically listed on the settlement statement you get at closing.”

In other words, the buyer is responsible for taxes on and after the sale date.

Have you already sold house?

To make sure you can write off your property taxes, you need to itemize your deductions. While it’s best to work with a tax professional who can crunch the numbers accurately and assess your situation better than we can, it might also be a good idea to review Schedule A (Form 1040) from the IRS to get acquainted with the details of how itemizing real estate taxes work.

Now that you’ve sold the property, make sure to bring your settlement statement to your tax appointment so you have official documentation for the date the buyer took over the house and property taxes.

Are you currently selling your house?

If you have the time, determine an estimate for how much you paid in property taxes last year and how much you’ve paid this year — wherever you’re at in the process of selling your house.

This way, you clearly understand your property tax responsibility and the buyer’s liability come closing time.

So, how do you figure out how much you’ve paid?

You can try these 3 options:

Myth: “If I have a home mortgage, I can’t deduct mortgage interest.”

Fact:

Americans have long enjoyed the mortgage interest tax break as one of the major benefits of owning a home. As of 2018 the IRS allows you to deduct interest on up to $750,000 of a loan (down from $1 million for loans obtained before the new Tax Code took effect). But even with the lower cap, most homeowners are able to deduct mortgage interest in its entirety using Form 1040, Schedule A.

In addition to mortgage interest, you should also check into whether you can deduct mortgage “points,” which describe charges you may have paid to get a mortgage like prepaid interest or loan origination fees.

However, keep in mind there are 9 requirements you must fall under to “deduct the points in full in the year you pay them,” which you can find on this page.

Still, as a homeowner looking to sell your house, it’s in your best interest to work with a tax professional who can both guide you through the itemizations form and confirm if you can write off mortgage interest and mortgage points, given the requirements.

Have you already sold your house?

Whether you sold you house at the beginning, middle or end of the year, we suggest you get your documents in order sooner rather than later so that you’re not forgetting about charges you incurred that could be written off.

For the mortgage interest deduction, consider printing itemization Form 1040 ahead of time and reviewing it. Then, once tax season rolls around, be on the lookout to receive Form 1098 from your lender, which will summarize the mortgage interest you paid for the year (the IRS requires that your lender sent it to you). You can use Form 1098 as you make inputs on your tax software, or simply provide the document to your tax professional as their prepare your returns and they’ll know how to use it for itemization.

Are you currently selling your house?

No matter how long your house has been on the market, if you have a mortgage on the house you’re selling — and it’s your main house — there’s a good chance you can deduct your mortgage interest from your taxes.

At this point, while your full attention should be on selling your home quickly and for as much money as possible — preferably with the help of an experienced agent — it doesn’t hurt to start reviewing the mortgage interest charges you’ve incurred since the last time you filed.

There’s a lot of information here. We know. But as you walk away, we want to leave you with a few parting points — whether you’re currently selling your house or you’ve already sold it and passed the baton to its new rightful owner:

When in doubt, we encourage sellers — and potential sellers — to consult with a tax advisor as deduction rules can vary from state-to-state, year-to-year and even administration-to-administration.

This way, you’ll feel more confident about maximizing the deductions available to you — given your marital status, your ownership and living situation and the dollar amount for which you sell your house.

by Amanda Hanna Posted on

Disclaimer: This article is not intended to be used as legal or professional tax advice; for questions or further information, please consult a skilled CPA.