NYC is the start for many young college grads, but where to live. DNA info reports on the next neighborhoods.

Month: June 2017

Looming Mass Transit Issues Create New NYC Real Estate Calculus

What to do next, when your train line is under construction. DNA info reports on a very telling story on this.

more “Looming Mass Transit Issues Create New NYC Real Estate Calculus”

Don’t forget the Mortgage Interest Deduction!

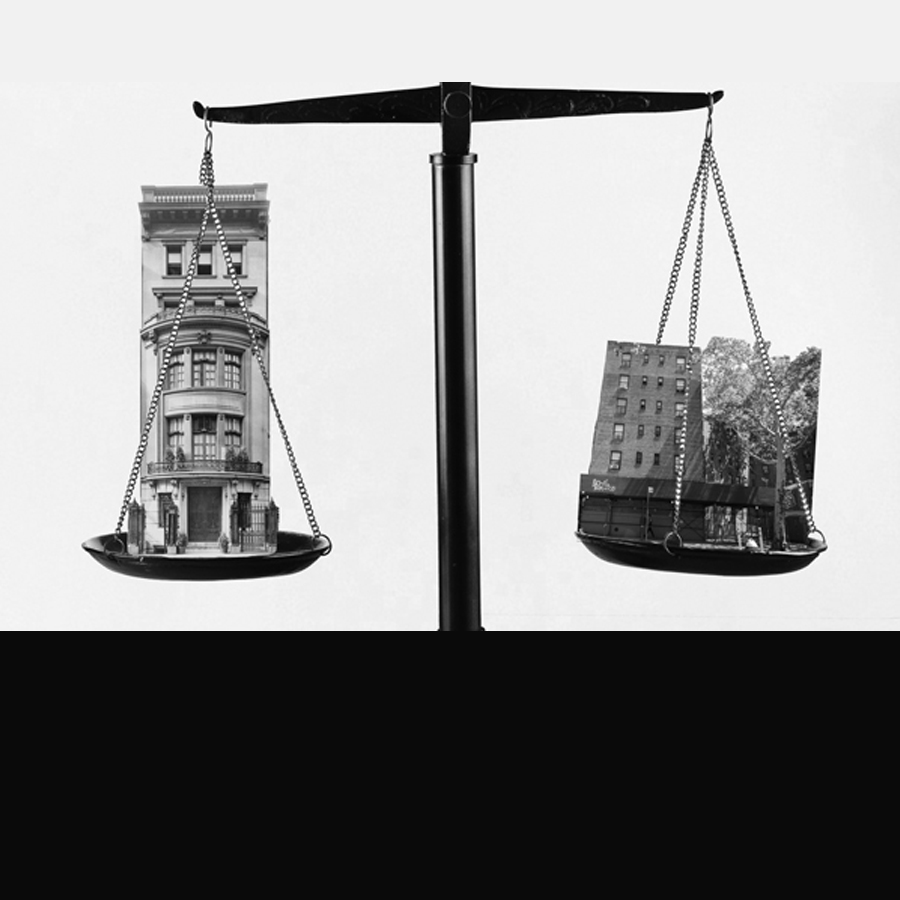

Mortgage Interest Deduction Lifts Housing Prices

There was an interesting article in The Real Deal Magazine column: The Long View. The mortgage interest deduction is America’s great inequalizer

The concept is pretty straight forward. When you introduce ways to cut costs for homeowners (i.e. making the payment smaller), the price moves higher. We see this in other mechanisms like tax deductions or low mortgage rates. The universe doesn’t remain in a vacuum while you solely enjoy the benefit. I’ve taken the deduction for years and have always been concerned about a price drop if this key homeownership incentive for housing activity was suddenly removed. Here’s why.

According to a well known 1996 study by Richard Green, Patric Hendershott and Dennis Capozza, U.S. home prices may be between 13 and 17 percent higher than they normally would be because of the MID. The logic is simple. The deduction makes it cheaper for Americans to take out mortgages, which means they can afford to pay more for homes, which artificially inflates demand, which in turn drives up home prices.

In addition to the mortgage interest rate deduction, land use regulations also push prices higher. Edward Glaeser, a noted author on this topic – and not because he has cited my market research in the past – wrote an interesting piece for Brookings on reforming land use regulations.

We changed from a country in which landowners had the relatively unfettered freedom to add density to a country in which veto rights over new projects are shared by a dizzying array of abutters and stakeholders. Consequently, we now build far less in the most successful, best-educated parts of the country, and housing prices in these areas are far higher than construction costs or prices elsewhere.

It is prudent to realize that value isn’t just inherent. Zoning, land use regulations, tax incentives are embedded in that value. So if those incentives are removed, the value will quickly drop. I’m not presenting rocket science here but housing value is not just “location, location, location.”

Are your window screens in?

It’s a lovely time of year to leave the windows open – but Is your landlord required to install screens in your windows?

According to Brickunderground :